Op-Ed: P.R. action plan-What should taxpayers look for?

The National Taxpayers Union, “The Voice of America’s Taxpayers,” is a nonpartisan, nonprofit organization working for lower taxes, smaller government, and economic freedom at all levels. More information on NTU’s work is available at www.ntu.org.

Washington, D.C. – Very soon, the House Committee on Natural Resources is expected to release draft legislation designed to address Puerto Rico’s chronic and serious financial woes. Throughout its deliberations, the Committee has consulted with many stakeholders, including taxpayers.

That’s where National Taxpayers Union (NTU) has come in. Over the past year, NTU has issued several communications on behalf of our members in Puerto Rico and the rest of the United States, including a legislative memorandum available here and, less than two weeks ago, additional detailed comments to the Committee available here.

Future posts will address specific aspects of legislation pertaining to Puerto Rico, but the following is a brief summary of NTU’s comments that taxpayers can use as a guide in the crucial debate that is about to take place.

1) Oversight and Stabilization. A federal oversight entity must be a part of any solution to assist Puerto Rico. Such an entity should have its powers confined to encouraging and implementing fiscal reforms and oversight mechanisms, rather than becoming immersed in debt restructuring issues. Its structure should be designed to accommodate the widest, most diverse range of financial experts to aid the Commonwealth in its economic renaissance.

Its first task should be establishing an independent auditing and accounting process for the island’s finances. Public corporations and the island’s public employee pension system must be included in the scope of oversight, as should overall decisions affecting the size of the bureaucracy. Finally, the oversight entity should consult international best practices on protections for government “whistleblowers” developed by some of the best experts in the field, which can be readily adapted to Puerto Rico.

We also recommend that Treasury facilities for advising indebted sovereign countries should be enlisted to assist the territory of Puerto Rico, and that a new U.S. executive branch task force should be created to expedite decisions on permitting, property sales, and other federal administrative policies affecting the Commonwealth.

2) Pro-Growth Economic Policies. In addition to corporate profit, individual income, and property tax reforms that the Commonwealth itself must still complete, Congress can design a new federal tax law approach to Puerto Rico that is compatible with the most-often discussed elements of international tax reform plans. These include repatriation and dividend exemptions as well as rules for foreign-sourced income. Doing so will bring about harmonization, rather than conflict, with the overall goals of a revised tax system.

Furthermore, besides establishing workable and enforceable budget-process rules, which the Commonwealth must embrace to reestablish fiscal credibility, the federal government must work with Puerto Rico’s government to free the island from unproductive policies created in Washington.

Encouraging diverse investment in energy infrastructure, instituting more standards for competitive bidding on federally funded projects in the Commonwealth, and designing a limited, workable reform to shipping restrictions are just a few ideas that would benefit the island’s taxpayers and consumers.

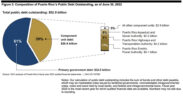

3) Debt Restructuring. NTU has extensively evaluated U.S. experiences with Chapter 9 bankruptcy as well as other countries’ laws, and has concluded that there are no simple fixes. A “Super” restructuring regime involving the Commonwealth’s “full faith and credit” debt would be tremendously counterproductive. Upholding the status of this debt is not about picking winners and losers, but is instead about reaffirming the importance of not disrupting this financing option states use to help fund priority projects.

We believe that Congress must undertake a thorough reevaluation of restructuring mechanisms, such as clarifying creditors’ rights, establishing supervisory processes, and solidifying the ground rules for future resolution of debt outside of the courts. Ideally this would take place with the intent of revising the laws to apply throughout the nation, not just to Puerto Rico.

Above all, Congress must avoid setting bad precedents that encourage U.S. states (and their pension plans) to seek debt bailouts and undermine the entire system of government credit.

Future U.S. policy toward Puerto Rico will have implications well beyond the Commonwealth’s shores. NTU will be in the thick of the action as this policy is formulated, because taxpayers on the island and the mainland deserve the highest consideration.