Op-Ed: Puerto Rico’s healthcare ecosystem systemic risk threat

The coronavirus outbreak has thrown the healthcare ecosystem throughout the US into a systemic risk crisis that includes both medical and financial. While robust institutions may be able to brush off the impact of the pandemic’s adverse effects, some healthcare ecosystems in Puerto Rico will not be able to recover.

As of April 26, Puerto Rico has accumulated 264,863 positive cases, of which 60.41% or 104,834 happened from Dec. 13, 2021. From Jan. 1, 2021, to Dec. 12, 2021, there were 79,978 cases, meanwhile from Dec. 13 to Feb. 5, 2022, in that short period, we have 105,367 cases, impacting healthcare ecosystems severely.

While we have 3,925 deaths, the current case growth rate has grown 143.80% and seeing a rise of 19.81% in casualties.

The worsening Omicron surge has the world concerned — during the last 28 days, the rise COVID-19 count is as follows:

- United States: 16,171,828 cases with 62,281 deaths.

- France: 8,669,030 cases with 7,074 deaths.

- India: 6,564,287 cases with 18,938 deaths.

- Italy: 4,184,797 cases with 9,733 deaths.

- Brazil: 4,017,216 cases with 12,263 deaths.

- Germany: 3,593,766 cases with 4,738 deaths.

- United Kingdom: 3,360,036 cases with 8,222 deaths.

Since the pandemic began on March 15, 2020, the estimated losses to the Puerto Rico healthcare ecosystem are $1.08 billion, in the United States mainland, the losses so far are more than $122 billion and rising with more than 70 healthcare ecosystems filing for bankruptcy or closing.

Puerto Rico is facing healthcare ecosystem systemic risk for all healthcare facilities

As Puerto Rico plays its role during these trying times, we must remind everyone that since 2017 we have been advising all our constituents that one of the biggest threats that the island faces is a Puerto Rico healthcare ecosystem systemic risk for all healthcare facilities

The US, including Puerto Rico, ranks first in per capita health spending. However, we are dead last in the health system performance of 11 major developed countries. Out of the total expenditure for health care, a whopping 38% goes toward healthcare ecosystems, and it has been this way for the last 50 years.

Another considerable challenge facing the Puerto Rico healthcare ecosystem and even those in the US is the fact that they are being forced to either reduce costs at the expense of creating potentially devastating impacts on the communities served or take less aggressive cost-cutting measures and risk facing severe financial hardships. The pandemic made this situation even direr.

This scenario to this indubitable Hobsons Choice has developed through profound public policy and market moves that transfer financial risk into local healthcare systems.

Healthcare ecosystems in Puerto Rico are, in many cases, the largest employer in their communities. With little or no financing available in Puerto Rico, it has become a stark similarity to the systemic risk crisis of 2008.

In our view, the most important lesson the financial crisis of 2008 taught us is the fact that is changing rules, poorly understood interdependencies, and lack of proactive management of the market forces would have dire consequences to the Puerto Rican economy and event for the U.S. economy itself.

With 3.5 million American citizens depending on our services that save lives, we must be sure we do not have to learn that lesson again in health care.

Another item that adds to the systemic risk is the Medicare fee-for-service (FFS) program expenditures are not a fundamental basis for Medicare Advantage (M.A.) rate-setting in Puerto Rico under the formula in the Affordable Care Act (ACA). A history of differential statutory treatment for Medicare and Medicaid programs and payments, coupled with a unique economic, cultural, and socio-economic context, has impaired the development of a healthcare economy in Puerto Rico as compared to elsewhere in the US.

The Medicare FFS program data that Congress considered as a standard for the ACA MA payment formula does not work in Puerto Rico.

The resulting anomaly is that Puerto Rico’s average M.A. benchmark is now 43% below the U.S. average, 38% below the standard in the lowest State (H.I.), and 26% lower than the USVI (just 9 miles away from Puerto Rico) has suffered benchmark reductions of over 20% since 2011, while the U.S. average benchmark has increased by 4% in the same period.

This reduction is the leading cause of the current financial challenges, which have, in turn, accelerated the outward migration of healthcare professionals.

There is a need to allocate funds to strengthen the healthcare ecosystem, not only to prevent them from being pushed to the edge financially, as they are now but to give them the necessary financial support.

Allowing to hire staff, build the essential infrastructure, and acquire sufficient equipment and materials to manage pandemics such as COVID-19 patients without overwhelming the capacity to treat other medical needs, and without unnecessarily exposing healthcare workers.

The Puerto Rico healthcare ecosystem is a significant sector of its economy, accounting for approximately 13.4% of the island’s total workforce. Nonetheless, Puerto Rico spends about 13% of its GDP on healthcare, an amount lesser than that of the United States. Puerto Rico’s healthcare system is predominately private but serves beneficiaries of “Vital,” the government-sponsored health plan which provides coverage to 38% of Puerto Ricans through Care Management Organizations (CMO).

To date, the allocation of funds per citizen residing in Puerto Rico is roughly one-third of the funds invested in the health of a citizen living in the mainland, and lower than in other territories of the US.

Due to the coronavirus pandemic, Puerto Rico’s healthcare ecosystem and medical facility sector are on the brink of collapse. The crisis can create a systemic risk collapse and force Healthcare ecosystems that are “too big to fail” institutions to close. Faced with that sober reality, the Government of Puerto Rico is moving quickly to protect the health of the 3.5 million Puerto Ricans and the broader economy by stabilizing the industry.

These actions will save millions of lives and American jobs, according to independent estimates.

In short, the Puerto Rico healthcare ecosystem needs a program like that of the Troubled Assets Relief Program that allowed for the US banking sector to survive under enormous economic pressure. The healthcare ecosystem crisis differs significantly from the 2008 financial crisis created by the housing bubble and Wall Street, the current healthcare ecosystem.

Among the banks that benefited due to the TARP program were:

Restrictive access to capital

During the last decade, Puerto Rico has seen its access to capital severely hindered; for one, we have seen the exodus of all International Universal banks and some local banks from Puerto Rico. With the losses accumulated, this scenario is even direr.

Since 2009, we have seen the following banks exit the Puerto Rico market:

As these nine banks exited the market with them, Puerto Rico lost more than 50% of its commercial lending capacity, and most businesses must utilize now “Alternative Lending Operations” that charge interest rates that surpass 20% in most instances.

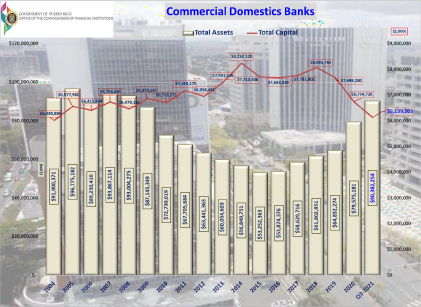

According to the Office of the Commissioner of Financial Institutions (OCIF, in Spanish), Well, during the same period from 2008 to 3Q21, Commercial Loan portfolios have fallen from $49.6 billion in 2008 to $21.8 billion in the 3Q21 a 44.09% reduction.

These are very significant reductions in a tendency that will worsen as the Puerto Rico banks control the market.

Lending initiative

Under the current budgetary climate, it is difficult to catch up on healthcare ecosystem payments to their required levels seriously. It is necessary to keep up with inflation and to keep up with a healthy capital investment program that allows Puerto Rico healthcare ecosystem to remain current with newer technologies and services. This is THE central issue to give Puerto Rico residents access to care locally.

COVID19 is the last straw.

Puerto Rico healthcare ecosystem are reeling from the necessary steps taken by the Government to curtail the spread of disease. The situation is dire to the point that we are at a crossroads in a moment where we need Puerto Rico’s medical facilities more than ever. If we have our medical institutions fighting to make ends meet instead of investing in preparedness for the coming epidemic, it can prove devastating to many. The government must step in and provide a safety net to our healthcare institutions. The government of Puerto Rico must create a robust program to finance and refinance medical facilities. If we apply the lessons learned from the banking crisis, loaning out to medical facilities at LIBOR would create enough savings across the board to get medical facilities back to health and back to their primary duty…taking care of patients.

To address the deficiencies as mentioned above, Congress is called upon to develop and support initiatives that cannot only address the immediate emergency threat of COVID-19 in the short run but also it must do so through long-lasting initiatives that can bring acute care healthcare ecosystem facilities up to standard, ranging from large teaching institutions to small rural critical access healthcare ecosystems, by having access to grants or affordable financing for remodeling, expansion, modernization, equipment, refinancing debt or to contract specialized professionals. These activities should be prioritized to existing health care providers, particularly those healthcare ecosystems with existing specialized medical units. The healthcare industry cannot be the subject of one more short-term solution that will reanimate it for this emergency just to have it fall soon after that.

Medical facilities that need to refinance their debts to replace high-interest rates must redirect their savings to incorporate mitigation and resilience measures to protect the healthcare system against the anticipated effects of future natural or human-made disasters. Also, attracting and retaining health-related businesses and jobs will improve advanced and specialized medical services in Puerto Rico.

Lending and investment programs initiative

The National Emergency Wellness healthcare ecosystem Lending Program (New Hope) is created with $1.5 billion in funding from the US government to support healthcare ecosystem operations in Puerto Rico and allow to expand the financing sources available for the healthcare ecosystem and medical facility operations of Puerto Rico.

To preserve their operations, enhance their capacity, increase their resiliency, and further their development and in tandem with the US Treasury to complement the Federal Reserve Bank’s lending capacity for this sector.

Currently, the healthcare ecosystem industry in Puerto Rico has total liabilities of $2.1 billion; most of the debt is due 75% to banks and the remaining balance to thousands of suppliers, including close to 5,000 small and mid-size entrepreneurs.

Establishing a national emergency wellness healthcare ecosystem lending program will allow Puerto Rico healthcare ecosystem to survive the worst pandemic of our generation. In trying times, American citizens have been able to stay with the help and support of the safety net that Congress has provided; we face a similar crisis this time.

New Hope will have the legal power to invest in capital stock, grant loans, and guarantee long-term loans for all accredited healthcare ecosystem and medical facilities.

- Maximum Advance Rates

- Real Estate: 120% of the fair market value

- Equipment: 100% of the fair market value

- Inventory: 90% of book value

- Accounts Receivable: 90% of book value (less than 180 days)

- Loan amounts to range from $5 million to $400 million:

- What are the loan terms? The maximum term is 30 years.

- Interest-only payments for the first five years

- Pricing and interest rates?

- Interest rates are to be fixed Libor for the term of the loan.

The New Hope will be designed around five basic principles:

- Protecting the financial health of all Healthcare ecosystems and by doing so, we protect 3.5 American citizens from Puerto Rico.

- Avert a systemic risk of the healthcare ecosystem while protecting “Too Big to Fail” healthcare institutions.

- Maximizing the impact of the governments’ Investment dollars: by using government financing in partnership with Federal Initiatives, thus creating significant purchasing power.

- Balancing the island’s economic development model, allowing the healthcare ecosystem sector to compete better.

- Shared risk and profits with the participants.

- What is the role of the government and Treasury? — Enters in agreements with implementing agencies/entities? Issues the loan, security, or guarantees loans under the New Hope program

- What is the US Treasury’s role? Originates, processes, and services loans.

- Submits guarantee applications to the State for review/approval and obtain assurances of eligibility from each borrower. Establishes terms and conditions, pricing, disbursement, contracts, budgets, reporting requirements, databases to support the program, and other administrative elements.

- What is the potential role of an implementing agency/entity? Acts on behalf of the State to administer the loan guarantee program. Assists in marketing the program in their region or community.

In conclusion

The COVID-19 emergency is disrupting the healthcare ecosystem’ operations because of the significant decrease in utilization has caused enormous losses, and there is an increased need to receive the sizable financial assistance by the governmental entities, whether it is the state or federal.

Certainly, the healthcare ecosystem has received sizable financial aid from the provisions of the CARES Act, however, the grants have not been enough to take the healthcare ecosystem into the black as most if not all continue to report losses.

Unfortunately, it is extremely difficult for the healthcare ecosystem to forecast what will happen in the incoming months because of the high level of uncertainty surrounding the healthcare ecosystem operations.