Op-Ed: Puerto Rico’s Plan of Adjustment in peril, we all face unknown journey

On July 1, 2016, Puerto Rico decided to default on its General Obligations bonds, a credit protected by our constitution and debt which should have NEVER defaulted.

Most of us realize the Financial Oversight and Management Board for Puerto Rico (FOMB) exists because our politicians could not avoid the financial crisis that led us to bankruptcy. While the FOMB has had the highest cost for our democracy, neither Congress or the local leaders could develop a more viable alternative.

WHILE ACCEPTABLE, the FOMB’s performance has made the necessary steps to create a better financial planning process for Puerto Rico’s government finances with a more careful and thoughtful analysis with a determined source of funding.

The FOMB has become a sort of referee between the government and Title III Judge Laura Taylor Swain. Although the FOMB has not been perfect, it has provided a fiscal balance that could hardly have occurred without them.

It is important to remember that back in 2016, when Puerto Rico decided to default on its obligations, the Government and then Gov. Alejandro García-Padilla, along with then-Commissioner Pedro Pierluisi, went to Congress to seek approval of bankruptcy law for Puerto Rico. The response from Congress was the PROMESA Act creating the FOMB and, as I said, at the highest cost to our democracy.

What happened in the hearing with Judge Swain?

Right out of the gate, after hearing arguments on the Plan of Adjustment from all parties, Judge Swain told the Board, the executive branch, and the legislature, “My patience with Puerto Rico is running out.”

After four-plus years of debate after debate, I cannot blame the Judge for feeling frustrated that the FOMB, the government and Legislature cannot agree on a path to lead us out of bankruptcy.

As the hearing ended, Judge Swain decided the following, and with a concise time frame:

If the version of House Bill 1003 that the legislative leaders plan to approve in 24 hours is not acceptable to the FOMB, then all parties will be subject to a mediation process to be conducted by Judge Barbara J. Houser and her staff.

This mediation process has to conclude on or before Nov. 2, 2021 at 5 pm, at which point Judge Houser would have to indicate to Judge Swain whether she believes that the confirmation hearing on the Plan of Adjustment can occur as scheduled for Nov. 8, 2021.

On the other hand, the FOMB has until Nov. 4, at 2 pm, to tell Judge Swain if by that time it has a confirmable plan, or what alternatives it has to the same or on the contrary if the FOMB will request the dismissal of Puerto Rico’s bankruptcy.

If this scenario occurs, all the work done so far would collapse and eliminate the famous “stay,” and this would initiate multiple lawsuits from all creditors trying to collect their money. Possible actions include freezing accounts, selling assets, foreclosing on collateral, in short, the worst possible process.

The FOMB was forced to go to the Legislature because the creditors demanded that the Legislature approve the new bond issues, which would establish the new debt payment commitment under the Plan of Adjustment. The governor must convert House Bill 1003 into law, which is why we are facing this process today.

For Puerto Rico, as a people, it is highly negative not to fulfill and honor our commitments. However, it’s worse to see how the trust of an entire population in its most important institutions is broken; the recent actions that have been taken in this process have been highly harmful and could have the worst outcome for Puerto Rico.

As a Puerto Rican, I am deeply troubled that a significant portion of the pensioners, who receive more than $2,000 in pensions per month, may be subject to cuts in their pensions, which are the product of more than 30 years of service to Puerto Rico. However, we must keep in mind that bankruptcy laws are laws of equity, and the debtor cannot decide in favor of some against others.

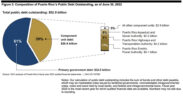

For example, more than 200,000 local investors lived off their savings, and for the last five years, they have not been paid a single cent of their savings. It is essential to mention that an investor is anyone who has bonds, IRA’s, Keough, 401k. These local bondholders have invested since 1996 an aggregate value of $42 billion in Puerto Rico bonds, and they are the most affected bondholders.

For any banker or financier to see a client, neighbor, friend, entrepreneur, or business face bankruptcy is a cause for grief, frustration, embarrassment, and a sense of defeat.

The bankruptcy process reminds me of something I read some time ago, and that is, “Every journey has a meaning that is unknown to the traveler.”

I am sure that this journey’s meaning has not been revealed to us, other than its consequences could be disastrous.

“Failure will never overpower us if our determination to succeed is strong enough,” therefore, I urge everyone to do the right thing to put this sad chapter in Puerto Rico’s history behind us.