Oversight Board reaches agreement on framework to restructure $35B in debt

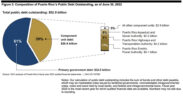

The Financial Oversight and Management Board for Puerto Rico announced it reached an agreement with certain Commonwealth bondholders on the framework for a plan of adjustment to resolve $35 billion worth of debt and non-debt claims against the government.

The agreement will reduce the amount of Commonwealth-related bonds outstanding to less than $12 billion, a reduction of more than 60%, the Oversight Board stated.

The Commonwealth’s debt service, including principal and interest over the next 30 years, would be cut by about half, to $21 billion from $43 billion, it added.

The agreement with the supporting creditors, which includes certain holders of Puerto Rico’s General Obligation and Public Buildings Authority bonds issued prior to March of 2012, “is an acknowledgement by bondholders, and other parties with claims against the Commonwealth, that Puerto Rico’s difficult financial situation requires a meaningful reduction in its debt burden to a sustainable level,” the Oversight Board said.

“The agreement is an important element of a plan of adjustment that would allow Puerto Rico to emerge from bankruptcy early next year. The Oversight Board expects to file that plan of adjustment for the Commonwealth within the next 30 days,” it added.

“The support agreement with creditors and the agreement with COR and the unions are milestones for Puerto Rico on the path toward a future with sustainable debt payments, secure pensions, and fiscal stability,” said the Oversight Board’s Chairman José Carrión.

“A Commonwealth plan of adjustment will provide investors with confidence that Puerto Rico has turned the corner after its financial crisis. The people of Puerto Rico will finally be able to live without the uncertainty of unsustainable government debt that so profoundly affected the Commonwealth’s ability to attract investors, create jobs and economic growth,” he said.

The agreement provides a greater than 60% average haircut for all $35 billion claims against the Commonwealth, a 36% haircut for holders of valid Puerto Rico general obligation bonds, and a 27% haircut for holders of valid Public Building Authority bonds guaranteed by the Commonwealth.

This agreement with bondholders, along with the restructuring agreement for the Puerto Rico Sales Tax Financing Corporation (COFINA) approved in February, reduces the Commonwealth’s maximum annual debt service payable in any future year by more than 70%, from $4.2 billion annually to below $1.5 billion a year.

In a separate statement, the Lawful Constitutional Debt Coalition, which includes GO and PBA creditors, said three months of negotiations have resulted in a Plan Support Agreement that establishes terms for the consensual restructuring of more than $18 billion in debt.

The Coalition’s members each signed the PSA made public. Other PSA signatories include members of the ad hoc group of Qualified School Construction and Qualified Zone Academy bondholders.

“It is a very positive development for Puerto Rico that a cross-section of large bondholders has worked with the Oversight Board to develop a consensual restructuring agreement that will accelerate the Commonwealth’s exit from bankruptcy, respect the lawful priority of valid public debt, and help ultimately restore capital markets access,” said Susheel Kirpalani of Quinn Emanuel Urquhart & Sullivan, LLP, in his capacity representing the coalition of creditors.

“This agreement demonstrates that creditors with long-term investments and interests in Puerto Rico are willing to make meaningful compromises intended to reignite capital formation and economic development on the island,” he said.

Under the terms, holders of valid GO bonds will accept baseline haircuts of approximately 36%.

“We believe this agreement’s terms provide all holders of GO and GO-guaranteed debt the opportunity to realize equitable recoveries based on their relative priority and rights,” said Kirpalani.

“We look forward to working alongside constructive stakeholders to achieve confirmation and then consummation of a Plan of Adjustment for the Commonwealth in the months to come,” he said.