Puerto Rico House approves 4% tax rate for future Act 60 investors

The new rate applies to capital gains, interest and dividends under the Incentives Code beginning next year.

The Puerto Rico House of Representatives has passed legislation that will impose a 4% tax starting next year on future investors receiving benefits under Act 60-2019, also known as the Incentives Code. Currently, these investors pay no tax on net capital gains, interest or dividends.

“This is part of a broader effort toward comprehensive tax reform,” said the chairman of the House Treasury Committee, Rep. Eddie Charbonier-Chinea. “Going forward, everyone who comes to the island under this program will pay 4%, which will increase government revenue.”

Charbonier-Chinea said the change could generate an additional $29 million to $69 million in revenue. Citing a report from the Legislative Assembly Budget Office (OPAL, in Spanish), he added that total collections under Act 60 could reach $279 million by 2040.

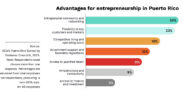

He defended the program, which has granted tax decrees to about 3,186 investors and, according to the Department of Economic Development and Commerce (DDEC, in Spanish), has helped create more than 75,000 jobs.

Robb Rill, founder of the Act 20/22 Act Society, also expressed support for the measure while advocating for expanded eligibility. “Throughout the years, we have been vocal in promoting the extension of the investor’s decree (formerly Law 22) to all Puerto Ricans,” Rill said. “We also support the continuity of the program with new investment requirements that will result in greater benefits and return on investment for the island. Therefore, we agree with the presented project, as long as it includes extending the benefit to Puerto Ricans.”

Charbonier-Chinea also noted that some beneficiaries are Puerto Ricans who had emigrated and returned to the island because of the incentives.

The Puerto Rican Independence Party opposed the bill. Rep. Nellie Lebrón-Robles criticized the 4% rate as “too low,” arguing it falls short of international tax standards, such as the 10% global minimum tax on large corporations. She warned that continuing preferential treatment could cost Puerto Rico up to $23 billion in potential revenue.

Lebrón-Robles also raised concerns about local communities and businesses being displaced by wealthy foreign investors.

“We support development and foreign investment,” she said, “but it must benefit the country as a whole — not turn us into a tax haven.”

House Bill 505 includes provisions allowing investors to access lower rates if they qualify under other tax laws or programs.