Funds advised by J.C. Flowers & Co. LLC and affiliates announced the closing of the acquisition of the personal loan and sale finance loan assets comprising the Island Finance business, which includes the employees and branches, from Santander Financial Services Inc.

DCDB Group, a global financial services consultancy firm, and Elevation, the consulting arm of NACHA–The Electronic Payments Association, administrator of the U.S. ACH Network, have formed a strategic partnership.

Oriental Bank has implemented a number of strategies to expand its customer base and increase its market share of young people and women, achieving sustained growth for the past 18 months, company officials said Wednesday.

The Puerto Rico Bankers Association is urging local citizens to help prevent fraud and financial exploitation in people who may be vulnerable, including the handicapped and the elderly.

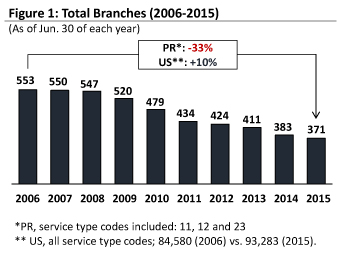

In the past 10 years, the size of the local economy has shrunk by 14 percent, total employment has dropped by 21 percent (more than 250,000 jobs) and the total population has decreased by 9 percent.

Government Development Bank President Melba Acosta-Febo announced Wednesday the range of government banking services that are now available to public corporations, agencies and municipalities, essentially provided at no charge.

Aurelio Alemán, president of First BanCorp, announced the appointment Wednesday of Donald L. Kafka as executive vice-president and chief operating officer.

Popular Inc. announced Monday a pair of appointees to its top ranks, namely Ignacio Álvarez as president and COO, and former Government Development Bank President Javier D. Ferrer as executive vice president, general counsel and chief legal officer for Puerto Rico’s largest financial institution.

The Economic Development Bank unveiled Thursday an online banking tool that allows its commercial clients to apply for loans and follow through on their applications, becoming the first financial institution in Puerto Rico to offer this type of service.

Less than a year after launching, Oriental’s check-image deposit service, “FotoDepósito” has generated more than $1 million in transactions from customers using their smartphones to interact with the bank, officials said Wednesday.

First BanCorp., the bank holding company for FirstBank Puerto Rico, reported Thursday net income of $17.1 million for the first quarter of 2014, or $0.08 per diluted share, compared to $14.8 million, or $0.07 per diluted share, for the fourth quarter of 2013 and a net loss of $72.6 million, or $0.35 per diluted share, for the first quarter of 2013.

It was two weeks ago that Puerto Rican banking veteran José Ramón González took over the helm of the Federal Home Loan Bank of New York, an institution that is one of the main driving forces behind the island’s financial district.

The Federal Home Loan Bank of New York announced Thursday that José R. González has been named president and chief executive officer of the FHLBNY effective April 1, 2014.

Puerto Rico's economy continued to be a hot button issue as growth continued to stall.

Following a year during which Puerto Rico’s banking sector has been mindful of its operating costs and some have specialized in areas where they believe to be most competitive, 2014 is expected to continue posing “serious challenges,” especially since the island’s economy is facing challenges of its own, Office of the Financial Institutions Commissioner Rafael Blanco predicted during a recent interview.

NIMB ON SOCIAL MEDIA