The sector also reported a total of 1.1 million credit union members.

The funds will help credit unions expand their services to communities usually affected by natural and economic disasters.

The “Adelanta en la IUPI” scholarship program is aimed at high school students looking to enroll in undergraduate college studies.

The financial health of the credit union industry is measured with four criteria: liquidity, solvency, asset quality and profitability.

Deutsche Bank confirmed the investment has been committed to Jesús Obrero Cooperativa.

COSSEC confirmed the “solidity and solvency of the credit union system.”

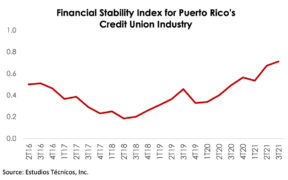

The Financial Stability Index for the Credit Union Industry in Puerto Rico, prepared by Estudios Técnicos Inc. (ETI), shows that conditions in this industry continued to improve in the third quarter of 2021. Economist Leslie Adames, director of ETI’S Economic Analysis and Policy Division, said “the index increased from 0.49 in the third quarter of […]

The Community Development Financial Institutions Fund awarded $5.5 million in technical assistance to 44 credit unions in Puerto Rico. The CDFI fund allocations are intended to reinforce credit union’s financial ability to develop products aimed at low-income populations with affected credit, young people with no credit history, and vulnerable communities that lack adequate access to […]

Puerto Rico credit unions “have a great opportunity” for expansion with the growing Puerto Rican migratory flow to the US mainland, where they can also grab part of the Hispanic market that does not yet have banking services, according to a study by local analysis firm Estudios Técnicos. Other growth challenges for Puerto Rican credit […]

The Puerto Rico Credit Union Executives Association (ASEC, in Spanish) announced its upcoming 20th local convention under the slogan “Cooperative Reinvention: Human, economic and digital approach” on Sept. 24-25. The event, which will take place at the Embassy Suites Dorado del Mar Beach Resort will be in person and will comply with all security protocols […]

The US Department of the Treasury today announced the allocation of $47.3 million in relief funds to 27 Puerto Rico-based credit unions, through its CDFI Rapid Response Program (CDFI RRP). The goal is to provide necessary capital for community development financial institutions (CDFIs) to respond to economic challenges created by the COVID-19 pandemic, particularly in […]

Conditions for Puerto Rico’s credit union industry continued improving as of the fourth quarter of 2020, with greater liquidity, asset quality and a 20% increase in total deposits, according to the new Credit Union Industry Financial Stability Index for Puerto Rico, produced by Estudios Técnicos Inc. (ETI). “The index increased from 0.38 in the fourth quarter […]

The Public Corporation for the Supervision and Insurance of Puerto Rico Cooperatives (COSSEC, in Spanish) confirmed that local credit unions will be able to access some $3 billion in budgetary allocations included in the new federal economic stimulus package that seeks to revitalize communities with low and moderate resources. The federal funding bill allocates $3 […]

A group of 32 credit unions in Puerto Rico received about $6 million in assignments from the U.S. Department of Treasury’s Community Development Financial Institutions Fund (CDFI Fund) to expand their services to economically disadvantaged communities. The allocation constitutes the largest amount granted by the U.S. Treasury to co-ops in Puerto Rico, reaching $10 million […]

The Credit Union Executives Association (ASEC, in Spanish) announced that credit unions that have members who own businesses and commercial clients, are ready to process loan applications for the second round of assistance funding through the U.S. Small Business Administration. Puerto Rico has more credit unions certified as SBA Lenders than banking institutions and “they’re […]

NIMB ON SOCIAL MEDIA