The debt is related to loans that the CRIM was granted in 2001 and 2002.

After more than five years, the US District Court for the District of Puerto Rico approved a Plan of Adjustment that reduces the commonwealth’s debt by 80% and saves Puerto Rico more than $50 billion in debt service payments. Among other matters, the plan orders modifying some $33 billion in central government obligations. In a […]

On July 1, 2016, Puerto Rico decided to default on its General Obligations bonds, a credit protected by our constitution and debt which should have NEVER defaulted. Most of us realize the Financial Oversight and Management Board for Puerto Rico (FOMB) exists because our politicians could not avoid the financial crisis that led us to […]

The Financial Oversight and Management Board for Puerto Rico (FOMB) has until Feb. 10 to present a Plan of Adjustment (POA), or at least a summary of the main terms thereof, to modify the central government’s debts with various groups of creditors. These debts include General Obligation bonds, bonds issued by the Public Buildings Authority, […]

The U.S. House Judiciary Committee approved legislation authored by Rep. Nydia M. Velázquez (D-NY) aimed at extending to firms working on Puerto Rico’s debt restructuring the same disclosure requirements that apply to companies involved in other bankruptcies. The bill, H.R. 683, is meant to address instances where companies consulting for Financial Oversight and Management Board for Puerto […]

What do Millennials, Gen Xers and Baby Boomers have in common? Not much, except that they all rack up debt this time of year. With each generation having its unique financial issues, Consolidated Credit is offering specific advice. Consolidated Credit analyzed four years of debt management program data and found that Millennial enrollments are at an […]

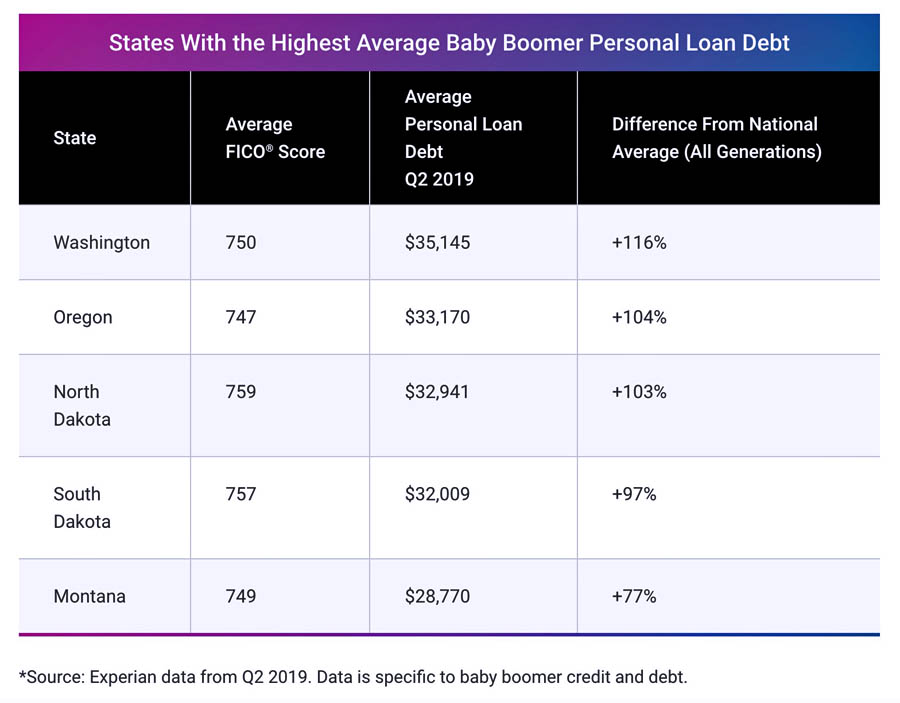

Baby boomers in Puerto Rico have the lowest personal loan balances, carrying an average of $10,158 in the second quarter of 2019, according to data released by consumer and business credit reporting and marketing services firm Experian data. “While this balance is still twice the national average held by Generation Z, it’s 38% less than […]

Puerto Rico bond insurers this month filed suit against eight well-known investment banks (UBS, Citi, Goldman Sachs, J.P. Morgan Securities, Morgan Stanley, Merrill Lynch, RBC and Santander) for failing to perform proper diligence on Commonwealth bonds worth approximately $11 billion. The train of neglect ran from 2001 to 2015 and included revenue and expenditure falsification […]

National Public Finance Guarantee Corporation and MBIA Insurance Corporation filed suit in the San Juan Superior Court against eight Wall Street banks to hold them accountable for “inequitable conduct in Puerto Rico’s municipal bond market that contributed to Puerto Rico’s economic collapse.” Plaintiffs are bond insurers that have been presented with more than $1 billion […]

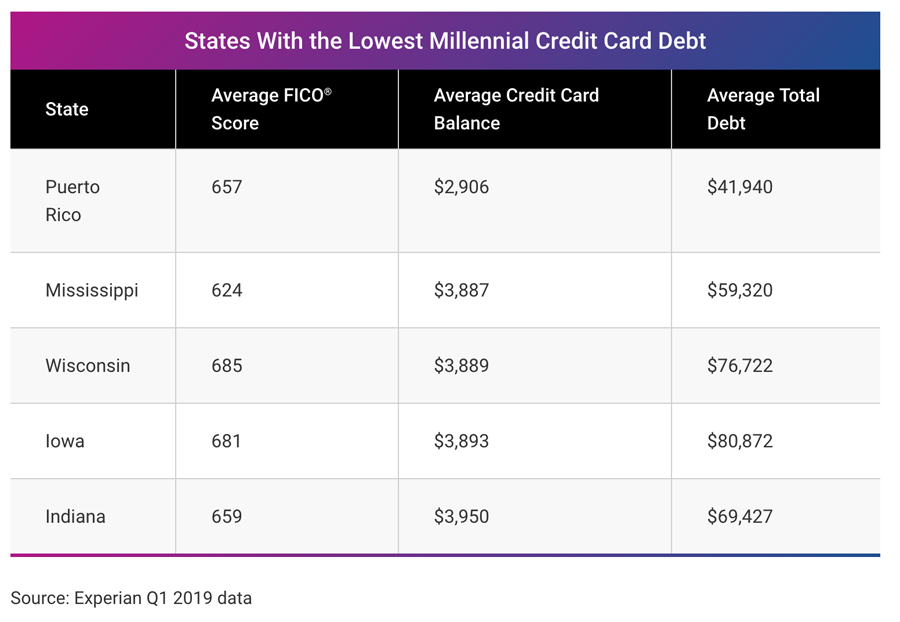

Millennials in Puerto Rico carried the least amount of credit card debt of any state, with an average balance of $2,906 per person, in the first quarter of 2019, according to a study conducted by credit reporting agency Experian. Mississippi millennials had the second-lowest debt, with an average credit card balance of $3,887. These balances […]

The current Financial Oversight and Management Board for Puerto Rico is attempting to invalidate more than $6 billion of general obligation bonds and to initiate clawbacks of principal and interest payments to bondholders. It claims that the bonds were issued in excess of a Puerto Rico constitutional debt limit, notwithstanding the Commonwealth’s specific representations to […]

The Financial Oversight and Management Board for Puerto Rico announced it reached an agreement with certain Commonwealth bondholders on the framework for a plan of adjustment to resolve $35 billion worth of debt and non-debt claims against the government. The agreement will reduce the amount of Commonwealth-related bonds outstanding to less than $12 billion, a […]

The government of Puerto Rico announced it has entered into a restructuring support agreement for $165 million in Puerto Rico Industrial Development Company debt with GoldenTree Asset Management, holder of over two-thirds of the agency’s outstanding revenue bonds. The RSA contemplates a financial restructuring of the PRIDCO Bonds through a Qualifying Modification under Title VI […]

NIMB ON SOCIAL MEDIA