Come January, when the new administration headed by Gov.-elect Alejandro García-Padilla takes over the reins of the government, it will have 90 days or so to present stateside credit agencies a “viable and concrete” plan outlining its strategy to tackle Puerto Rico’s fiscal problems, executives from the Center for the New Economy said Tuesday.

Puerto Rico’s current economy is smaller and less populated than when many of its legal and government structures were effected, making it necessary to refocus development policies to be able to move forward.

Assuming that Puerto Rico’s economy were to grow at an annual rate of 1.75 percent starting in 2014, it would take six years for it to bounce back into pre-recession growth levels, local firm Estudios Técnicos predicted Thursday.

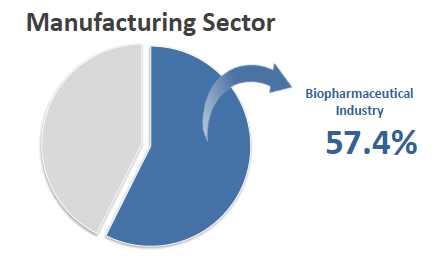

The biopharmaceutical industry is a major driver of Puerto Rico’s social and economic development, not just for the 86,000 direct and indirect jobs its creates, but for the multiplier effects it has upon other sectors.

Now that the dust has settled on one of Puerto Rico’s most contentious political campaigns and elections, the island’s private sector is hopeful that government officials, especially Governor-elect Alejandro García-Padilla, will set aside partisan bickering to work together to re-energize and move the economy forward.

Puerto Rico Governor-elect Alejandro García-Padilla will be undertaking an administration facing a very difficult scenario, with severe resource restrictions.

In very few elections will the economy be so present in the minds of Puerto Rico voters as in the one coming up Nov. 6.

Puerto Rico is the best place in Latin America and the Caribbean to start a business and gain access to credit and is outranked only by Chile in the overall ease of doing business, according to the “Doing Business 2013: Smarter Regulations for Small and Medium-Size Enterprises” report released Tuesday by the IFC and World Bank.

The lack of seriousness and responsibility reflected by the comments made by the president of the Government Development Bank of Puerto Rico are truly disturbing.

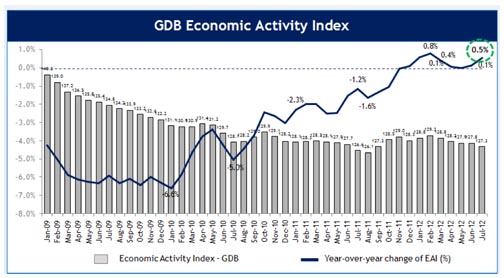

During the past 12 months, Puerto Rico’s economic activity has gained ground, as the recession is no longer deepening. This scenario is in addition to the appearance of the first signs of an early recovery stage — albeit moderate — and seeing the first pieces of evidence indicating that the recession is over.

One of the many consequences of globalization, and of the technological change that to a significant extent made it possible, is that the meaning of terms used in economic development has changed.

Dr. John Stewart, who worked for many years as an economic advisor at the Puerto Rico Industrial Development Company, used to say that if you tortured the statistics long enough, they would tell you what you wanted to hear.

The Government Development Bank unveiled the Economic Activity Index (GDB-EAI) for the month of July, which settled at 127.3, reflecting a 0.5 percent year-over-year increase.

As part of its ongoing support of Puerto Rico’s small and medium businesses, FirstBank offered a seminar Wednesday night to its business customers on "Opportunities for entrepreneurs within the new tax frame," conducted by CPA Gabriel Hernandez of the BDO Puerto Rico accounting firm.

NIMB ON SOCIAL MEDIA