The sector also reported a total of 1.1 million credit union members.

Inflation, a decrease in income and an increase in mortgage rates have set the stage a the 60% drop in buying power.

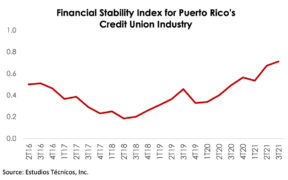

The financial health of the credit union industry is measured with four criteria: liquidity, solvency, asset quality and profitability.

The Financial Stability Index for the Credit Union Industry in Puerto Rico, prepared by Estudios Técnicos Inc. (ETI), shows that conditions in this industry continued to improve in the third quarter of 2021. Economist Leslie Adames, director of ETI’S Economic Analysis and Policy Division, said “the index increased from 0.49 in the third quarter of […]

After a year of stabilization in the labor market and some economic sectors’ recovery following the dislocation caused by the COVID-19 pandemic, it is possible to expect a moderate economic growth of 2.0% by the end of fiscal year 2022, according to economic analysis firm Estudios Técnicos Inc. “The favorable performance of the Puerto Rico […]

The Puerto Rican banking industry has continued to strengthen over the past year, supported by an increase in liquidity and the strengthening of asset quality. The Financial Stability Index for Commercial Banks in Puerto Rico, prepared by Estudios Técnicos, Inc., increased to 0.60 in the third quarter of 2021, compared to 0.47 in the same […]

Professional consulting firms CMA Architects & Engineers LLC (CMA) and Estudios Técnicos Inc. (ETI) will collaborate with Puerto Rico municipal governments in the development of their recovery plans as part of the efforts of the Municipal Recovery Planning Program, they announced. The municipal recovery program subsidized with CDBG-DR funds, will not only provide the municipalities […]

A study commissioned by the Puerto Rico Sales and Marketing Executives Association (SME, in Spanish) revealed that 78% of Puerto Rico residents believe that quality of life on the island is worse now than it was five years ago. Of that group, 84% are women mostly between 55 and 64 years of age, as well […]

Puerto Rico credit unions “have a great opportunity” for expansion with the growing Puerto Rican migratory flow to the US mainland, where they can also grab part of the Hispanic market that does not yet have banking services, according to a study by local analysis firm Estudios Técnicos. Other growth challenges for Puerto Rican credit […]

CEO Ataveyra Medina-Hernández launched a call to the legal community to complete the 2021 version of the longitudinal study on the legal services market in Puerto Rico. The 2021 edition of the study commissioned by Microjuris.com and Estudios Técnicos Inc. proposes to identify the new scenarios and work modalities to analyze how the legal services […]

The dramatic increase in international maritime freight rates, which was triggered by the COVID-19 pandemic, should force a rethinking of cabotage laws and the issue of food self-sufficiency in Puerto Rico. That is the assessment presented by Economist José Joaquín Villamil, CEO of Estudios Técnicos Inc., in the firm’s publication, “ETI Trends.” “Since the onset […]

The population trends in Puerto Rico reflected in the latest 2020 Census report will require the government to adopt strategies and policies to address a population situation very different from the one that has characterized the island. Furthermore, there are fewer people living on the island and in this reduced population, the older cohorts have […]

The Financial Stability Index of commercial banks in Puerto Rico, prepared by Estudios Técnicos Inc., shows a strengthening in the banking industry this year, mainly due to an improvement in its liquidity and increases of $16 billion in deposits in the first quarter of 2021. “The index increased from 0.52 in the first quarter of […]

Conditions for Puerto Rico’s credit union industry continued improving as of the fourth quarter of 2020, with greater liquidity, asset quality and a 20% increase in total deposits, according to the new Credit Union Industry Financial Stability Index for Puerto Rico, produced by Estudios Técnicos Inc. (ETI). “The index increased from 0.38 in the fourth quarter […]

The Financial Stability Index for Puerto Rico’s banking industry, prepared by Estudios Técnicos, Inc. (ETI), shows that the industry’s liquidity and solvency remain strong despite the current economic environment. “The financial stability index for Puerto Rico’s banking industry has recovered after declining from 0.64 in the fourth quarter of 2019 to 0.54 in the first […]

NIMB ON SOCIAL MEDIA