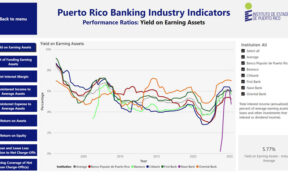

New interactive tool compiles FDIC-regulated bank data since 2001. #NewsismyBusiness

Nicolás Pérez-Alvarado pleaded guilty to misappropriating nearly $20,000 while serving as deputy operations manager in Puerto Rico. #NewsismyBusiness

The agency is hosting the “Economic inclusion roundtable: Financial services, asset building & economic development in the Southern Region of Puerto Rico” event next month. #NewsismyBusiness

The island’s Economic Development Bank partners with the U.S. Treasury to expand credit options. #NewsismyBusiness

Popular Inc. CEO Ignacio Álvarez confirmed that the Apple Pay service will finally become available in Puerto Rico this year. #NewsismyBusiness

“Banks in Puerto Rico are sufficiently well-capitalized and strategically diversified, so their customers’ deposits are completely safe," said OCIF Commissioner Natalia Zequeira.

The 2022 Annual Compliance Seminar gathered more than 100 professionals from the financial sector and other industries.

The action responds to the property damage experienced by consumers in Cataño, Dorado, Toa Baja, Vega Alta, and Vega Baja because of the storms that soaked Puerto Rico Feb. 4-6.

The FDIC announced a series of steps intended to provide regulatory relief to financial institutions and facilitate recovery in areas of Puerto Rico affected by earthquakes. In a release, the regulatory body stated the measures would apply to all FDIC-supervised financial institutions with total assets under $1 billion. The FDIC is encouraging banks to “work […]

The Puerto Rico Bankers Association and the Federal Corporation Deposit partnered to offer the 2018 edition of their "Minority Depository Institution Compliance Seminar.”

Popular Inc. announced that, on May 22, its subsidiary Banco Popular entered into a Termination Agreement with the Federal Deposit Insurance Corp.

Popular Inc. reported a net loss of $4.1 million for the quarter ended Dec. 31, 2016, compared to net income of $46.8 million for the quarter ended Sept. 30, 2016.

Banco Popular de Puerto Rico lost its appeal before a review board over a dispute with the Federal Deposit Insurance Corp. earlier this year that will result in a $115 million pre-tax charge for the quarter ended Dec. 31, the bank confirmed Wednesday.

The Puerto Rico Bankers Association of Puerto Rico, jointly with the Federal Deposit Insurance Corporation, recently hosted a two-day “Minority Depository Institution Training Seminar,” marking the 10th time the organizations team up to offer it.

Banco Popular de Puerto Rico announced Tuesday that it lost an appeal before a review board deciding over a dispute with the Federal Deposit Insurance Corp., representing a $55 million hit for the bank.

NIMB ON SOCIAL MEDIA