Defense Credit Union Council says SB 675 risks higher costs, while sponsors cite consumer protection. #NewsismyBusiness

Puerto Rico Gov. Wanda Vázquez announced that Treasury Secretary Francisco Parés passed an administrative order exempting prepared foods from the island’s sales tax, effective today through April 19, 2020. “This is an additional measure that’s taken in favor of all citizens in the face of the health emergency that we are facing due to COVID-19,” […]

Sales Tax Financing Corp. bondholders submitted an Agreement in Principle in the U.S. District Court in Puerto Rico, potentially ending its dispute with the island’s government.

A group of Puerto Rico Sales Tax Financing Corp. (known as COFINA in Spanish) stakeholders expressed concern about the government’s alleged release of inaccurate information about Sales and Use tax (SUT) collections.

The Puerto Rico Treasury Department favored Monday a bill that would give it the tools to Sales and Use Tax on sales of taxable products in Puerto Rico sold online by businesses without physical presence on the island.

Treasury Secretary Juan Zaragoza-Gómez confirmed Wednesday that net revenues recorded by the General Fund in March 2016 totaled $929.7 million, a $91.1 million increase compared to March 2015 net revenues, and $5.3 million below revised estimates.

Puerto Rico and the state of Kansas implemented the most significant sales tax rate increases in 2015, according to the annual sales tax rate study released Wednesday by corporate tax solutions provider Vertex Inc.

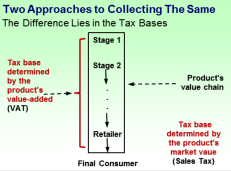

House Speaker Jaime Perelló told Treasury Department officials during a hearing Wednesday that they need to “go back to the table” on certain aspects of the proposed tax reform, including the frequency with which consumers will receive rebates to mitigate the impact of the new 16 percent value-added tax structure.

Puerto Rico Gov. Alejandro García-Padilla offered a televised speech Tuesday in which he outlined his proposal for overhauling the island’s current tax system to what he described as a “simpler and fair one.”

The implementation of a value-added tax system in Puerto Rico to replace the current sales tax structure could have a number of consequences — from uncertainty to high inflation to lower than expected fiscal revenue — that have yet to be publicly discussed, economist firm H. Calero Consulting said in its most recent “Economic Pulse” publication.

Thirty-two businesses operating in the upscale Palmas del Mar community in Humacao are facing a collective $373,000 in fines for failing to remit sales and use tax (known as IVU in Spanish) payments to the agency.

As part of the government’s strategies to increase tax evasion oversight, Puerto Rico Gov. Alejandro García-Padilla sent a bill to the Legislature that will allow the use of certified payment processors in all local businesses, as well as the exchange of information between municipalities and the Treasury Department.

The Puerto Rico Treasury Department has assigned 20 agents to find and fine businesses in the towns of Carolina and Trujillo Alto who have failed to remit sales and use tax money, as required by law.

Representatives from Puerto Rico’s telecommunications sector presented a united front Tuesday against the proposed elimination of the business-to-business tax exemption, saying “far from helping the island solve its fiscal problems, it will trigger a double-digit increase in the price of products, services, operating expenses and the cost of living in general.”

The Puerto Rico Treasury Department is currently working on a number of enforcement and automation initiatives to increase the island’s sales and use tax uptake from the current 68 percent while attacking the government’s fiscal shortfall, agency Secretary Melba Acosta told participants of the Puerto Rico Credit Conference Friday.

NIMB ON SOCIAL MEDIA