The University of Puerto Rico at Humacao and its School of Business Administration will be offering free services to taxpayers needing to fill out their 2014 returns, the college announced Monday.

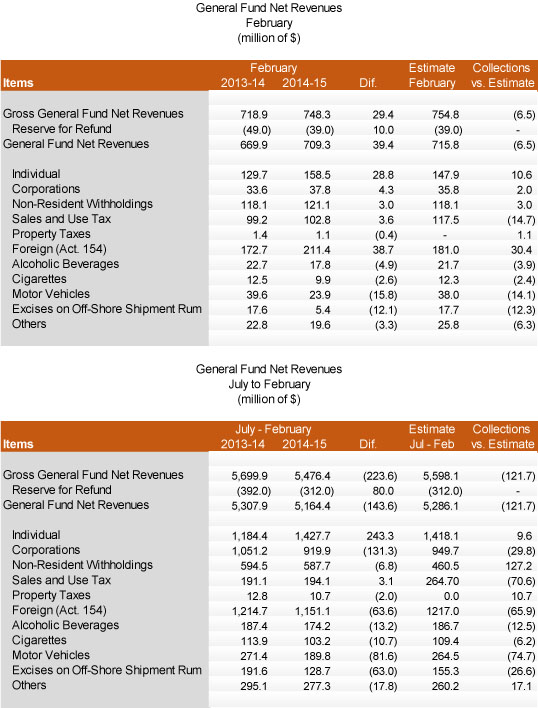

The Puerto Rico Treasury Department collected $709.3 million in February for the General Fund, a figure that was up $39.4 million, or 5.9 percent when compared to the same month last year, and $6.5 million, or 0.9 percent, below estimates.

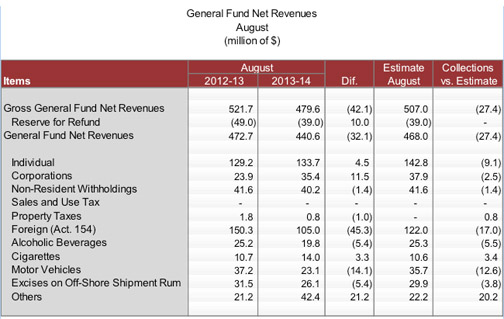

Puerto Rico’s General Fund net collections fell short of projected estimates by $27.4 million last month, when the government collected $440.6 million, hit mostly by a drop in payments from corporations under Law 154, motor vehicle sales and individual payments.

Doral Financial Corp. and Puerto Rico government officials were back in the public eye Tuesday, when both parties took to the media to defend their reasons for a collapse in court-ordered negotiations regarding a $229 million tax refund the former is claiming, and the latter rescinded.

A group of 182,442 customers of the defunct Centennial de Puerto Rico will be splitting about $1 million after winning a class-action suit against the carrier that is now part of AT&T Puerto Rico over improperly collected municipal tax fees from July 2009 to December 2009.

Following a “deep analysis,” the Puerto Rico Treasury Department denied Doral Financial Corp.’s request for a refund of $230 million it claims to have overpaid in taxes, voiding an agreement struck in March 2012.

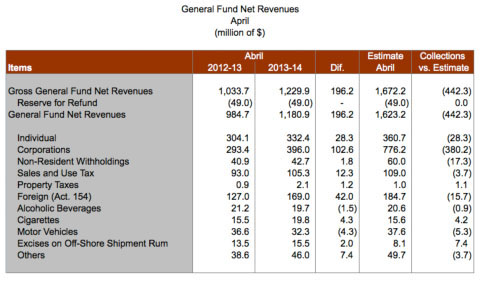

Two of the island’s largest private-sector trade groups, the Puerto Rico Chamber of Commerce and the CPA Society, weighed in Wednesday on the possible reasons for the $442 million revenue shortfall the Treasury Department reported for the month of April.

Financially troubled Doral Financial Corp. fired off a letter to the Puerto Rico Treasury Department late last week asking the agency to comply with the terms of a closing agreement reached in 2012 obligating the government to refund the bank for tax over-payments estimated at about $232 million.

Puerto Rico’s revenue collections for the month of April fell significantly below estimates, short by $442.3 million at $1.18 billion, but up by $196 million year-over-year, the Treasury Department said in a release distributed after the end of business Friday.

The Puerto Rico Treasury Department announced Wednesday it has cut $147.2 million in tax refunds corresponding to 247,744 tax returns during the current tax cycle, representing $80 million more than what was disbursed at this time last year.

The Puerto Rico Treasury Department announced Sunday it will be offering extended hours at its nine tax orientation and preparation centers and 18 collections centers islandwide on Monday and Tuesday, thus wrapping up this year’s tax season.

Puerto Rico Resident Commissioner in Washington, Pedro Pierluisi, on Thursday praised the Senate Finance Committee’s decision to extend, for 2014 and 2015, a package of expired tax provisions known as “tax extenders.”

All U.S. citizens are subject to U.S. Internal Revenue Code provisions, regardless of their place of residence or the source of their income. All people born in Puerto Rico are U.S. citizens.

The Puerto Rico Treasury Department is kicking this year’s tax season into high gear this week, when it will begin cutting tax refund checks and will open eight tax return orientation and preparation centers today, agency officials said.

An Individual Retirement Account is one of very few deductions that remained available in the income tax return after the approval of the new Internal Revenue Code.

NIMB ON SOCIAL MEDIA