Op-Ed: Is there any good news for P.R.’s small biz?

Amid news of credit degradation, income tax increases, rumors of raises in the sales and use tax, and possible changes to the federal minimum wage, you can almost hear the groans of small and medium business owners throughout Puerto Rico.

We could write pages and pages of all the tax legislation changes and how they could adversely affect small and medium size businesses in Puerto Rico (and will probably do so along with some possible solutions), but in this article we wanted to ask the question: is there any good news for small businesses in Puerto Rico? The answer is yes.

Although there were no particular big incentives introduced for businesses during 2013, we wanted to walk through the maze that is the legislation changes that have been introduced in 2013 and early 2014 to see what good news we could bring to businesses owners. Along our journey we found incentives — some new, some old — that could provide some relief to small and medium and businesses.

Pay your taxes, get a discount

As you can imagine, due to the economic situation in Puerto Rico and all around the world, some of the incentives granted in 2013 and early 2014 are related to amnesties that allow taxpayers to pay their tax debts with significant discounts. These types of incentives have two goals: (1) raise funds for the government and (2) allow discounts to taxpayers, including small businesses in moments when we are facing tough economic times.

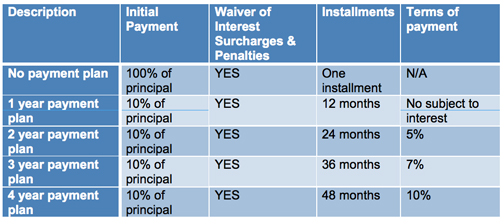

The first of these amnesties is the “Ley Ponte al Día con el CRIM”, or Act 145 of Dec. 9, 2013. Subject to certain conditions, this Act provides an incentive plan for the payment of personal and real property taxes for taxable years before 2013 and fiscal year before 2013-2014 respectively. The incentive plan is summarized as follows:

You will have until March 27th 2014 to take advantage of the benefits of this Incentive Plan.

The other current amnesty is the “Ley Ponte al Día con tu responsabilidad Patronal” or Act 15 of Jan. 3, 2014. Similar to Act 145, it provides an incentive plan for the payment of payroll taxes related to unemployment, workmen compensation, chauffeurs insurance, and “SINOT.” This incentive plan will apply for the payment for tax debts accrued as of June 30, 2013 and the payment terms are the same as those provided in the table above for property tax purposes.

The Department of Labor and Human Resources and the State Insurance Fund Corporation will have 60 days after the approval of the Act to issue guidance on the incentives plan, and after that period will begin a 30 day period of orientation. After the orientation period expires, the incentive plan will become effective for a period of 100 calendar days.

The mileage log is finally here

If you have heard about the requirements regarding auto expenses and mileage recordkeeping, you are probably scratching your head asking why this is good news. In the spirit of looking into bright spots in difficult situations here is a perfect situation.

Starting 2014, businesses will only be able to deduct for auto expenses an expense equal to 60¢ per mile instead of the actual auto expenses incurred. This means that now business owners will have to keep track of actual mileage use of the autos used for business purposes. There are two methods for calculating the automobile expenses: you can take the actual mileage of the autos and multiply by the rate established by the Puerto Rico Treasury Department, or you could use the Puerto Rico Highway Authority’s mileage calculator that indicates the distance between municipalities and multiply said mileage by Treasury’s rate.

The bad news, as you might imagine, lots of recordkeeping; the good news is you may have a deductible expense that could be higher than what you actually incurred. It is very important that you start with the appropriate recordkeeping as soon as possible. This due to the fact that first, it will be a very easy expense to be questioned by Treasury and second if you are one of the lucky ones where the mileage deduction is higher than actually incurred. You will never know if you don’t do the calculations.

Time to create employment now

The first act enacted in 2013 was the Jobs Now Act or Act 1 of Feb. 10, 2013. Said Act provides incentives for certain businesses that are eligible, including: an energy credit, partial exemption from property taxes, partial salary reimbursement, income tax and municipal license tax incentives, among others. The date for requesting the incentives under Act 1 has been extended until May 30th 2014.

Look outside Puerto Rico

One of the best opportunities out there for struggling business is to look outside Puerto Rico and start exporting services to foreign and United States markets. Not only does this makes business sense, but if you do, your export operation may be eligible for the benefits of Act 20 of Jan. 17, 2012 also known as the “Act to Promote the Export of Services.”

Act 20 provides benefits for eligible business that export their services outside Puerto Rico. Specifically it grants a reduced corporate income tax rate of 4 percent, 100 percent exemption on eligible dividends and 60 percent exemption on municipal and license taxes. At a time when all we hear is increases in taxes, these incentives provide a much-needed relief and make the possibility of exporting services more attractive.