Universal Life Insurance Co. summarizes tax campaign, shares insight on retirement planning

ADVERTORIAL

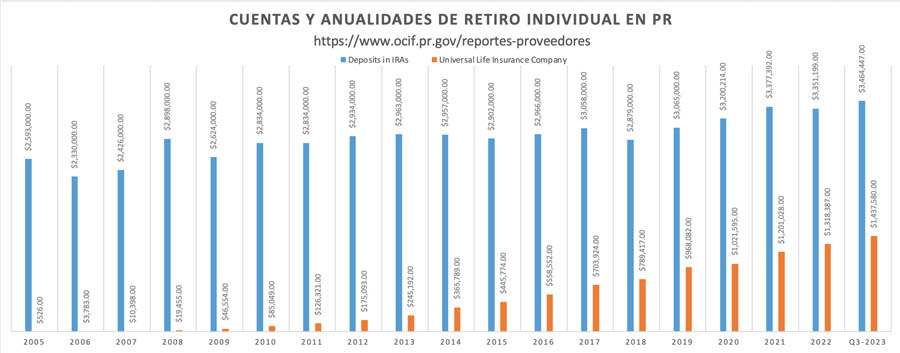

“It was a very busy period; it always is each year. We see more and more people concerned about having savings or investments with a view to the future. Nowadays, people do not open an IRA just for tax savings, but they take advantage of an additional tax incentive when the opportunity to save is present. We just had our most successful tax season, with over $287 million in deposits across annuities and IRAs. Many of the IRA deposits were transfers from other institutions, as we have heavily invested in innovation to bring the best alternatives to the Puerto Rican market.”

— Ramón Domenech, vice president, Universal Life

A significant reason why Universal Life Insurance Company has become the leader in this market, is its focus on developing financial solutions with tax benefits for Puerto Ricans, offering alternatives for every risk profile. These include fixed interest options, options that offer principal security with participation in the performance of financial indices, and their latest development: Universal VIA Generation Growth.

The latter is aimed at those who wish to invest directly in the stock market, with access to more than 43 investment alternatives professionally managed by renowned advisors such as Fidelity, Goldman Sachs, Alliance Bernstein, among others, and registered with the SEC.

This allows your financial advisor to create a personalized strategy tailored to your needs, with the flexibility to make changes between investment alternatives as your conditions or economic conditions change.

As mentioned, many of the funds received during this period come from maturing retirement plans. Due to the demographic challenges on our island, many people approaching retirement age seek to protect their income and have found in these alternatives the ability to secure lifetime income for the individual or the couple, which is undoubtedly the primary concern of a retiree.

These developments are carried out in conjunction with our risk management program, which for the past 20 years has evaluated business partners, investment managers and over a dozen reinsurers with extensive experience in these markets outside Puerto Rico.

Although some are aware of the situation we faced with one of these reinsurers, PBLA, our discipline and financial strength, along with a philosophy of diversification in reinsurance, have allowed us to continue developing nimbly and growing in this market.

Our commitment to Puerto Rico is to continue developing and providing our finance and insurance professionals with the best solutions, innovative tools, and accessible information to all our financial advisors and clients through our platforms, such as Universal Mobile Plus, which already allows our policyholders to access updated information on their policies, annuities and IRAs daily.