2nd back-to-school tax holiday slated for Jan. 10-11

The exemption period offers relief for parents ahead of the new semester, Puerto Rico Gov. Jenniffer González said.

Purchases made through mail order, telephone, email, or online will qualify for the exemption if the item is paid for and delivered to the buyer during the stated exemption period.

The Puerto Rico government’s second tax holiday of the year, exempting school supplies from the island’s Sales and Use Tax (IVU, in Spanish), will take place on Jan. 10-11, Gov. Jenniffer González announced.

“During these two days, [parents and guardians] will be able to purchase everything they need to begin the second semester of the 2024-2025 school year,” González said.

She advised parents to review the list of exempt materials and uniforms outlined in Internal Revenue Circular Letter No. 24-12, available in Spanish through the Treasury Department’s website.

“The sales of school materials and uniforms without IVU provide relief for parents and guardians while boosting economic activity,” González noted.

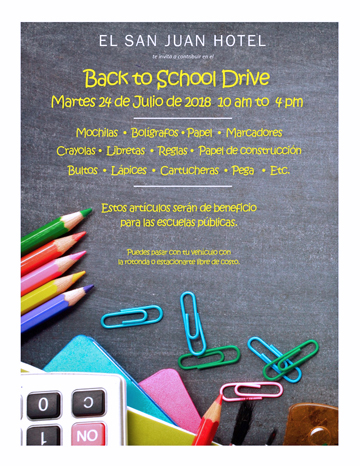

The list of exempt school materials includes items such as folders, calculators, crayons, erasers, binders, glue, markers, various types of paper, pencils, pens, protractors, rulers and scissors. Items used in art and music classes, such as paints, brushes, sketchbooks and musical instruments, are also eligible.

The exemption applies to required school uniforms, which must be specifically designated by the educational institution and not used as everyday clothing. Complementary items, such as shoes, are included, but accessories like belt buckles, patches and sewing materials are excluded. Protective gear, sports equipment and general-use clothing are also not covered by the exemption.

The IVU exemption includes grade books and electronic books listed as required by schools or universities.

“Printed and electronic textbooks required on an official list of school and university books and grade books can be purchased IVU-free throughout the year,” the government stated.

The exemption applies to layaway purchases when the final payment is made during the exemption period. It also covers items purchased through mail order, phone, email or online if they are paid for and delivered during the tax-free period. Pre-ordered merchandise delivered to the buyer during the exemption period will also qualify for the IVU exemption.