The app is available for download through Google Play or the App Store.

The Oracle of Ohama Warren Buffet cleverly stated some words that will live forever “Despite some severe interruptions, our country’s economic progress has been breathtaking. Our unwavering conclusion: “Never bet against America.” This statement was part of Berkshire Hathaway’s annual report letter written by Mr. Buffet that has become a yearly event. With the mantra […]

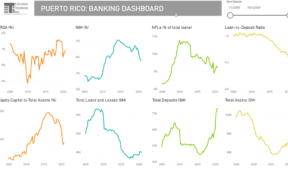

The Puerto Rican banking industry has continued to strengthen over the past year, supported by an increase in liquidity and the strengthening of asset quality. The Financial Stability Index for Commercial Banks in Puerto Rico, prepared by Estudios Técnicos, Inc., increased to 0.60 in the third quarter of 2021, compared to 0.47 in the same […]

Sun West Mortgage Company, with 41 years in the United States market, and presence in 48 states, Puerto Rico and the US Virgin Islands, was recognized as “Banking Institution of the Year” by the Puerto Rico Association of Realtors as part of the celebration of its annual convention. In addition, Andrés Concepción, Sun West’s vice […]

The Financial Stability Index for Puerto Rico’s banking industry, prepared by Estudios Técnicos, Inc. (ETI), shows that the industry’s liquidity and solvency remain strong despite the current economic environment. “The financial stability index for Puerto Rico’s banking industry has recovered after declining from 0.64 in the fourth quarter of 2019 to 0.54 in the first […]

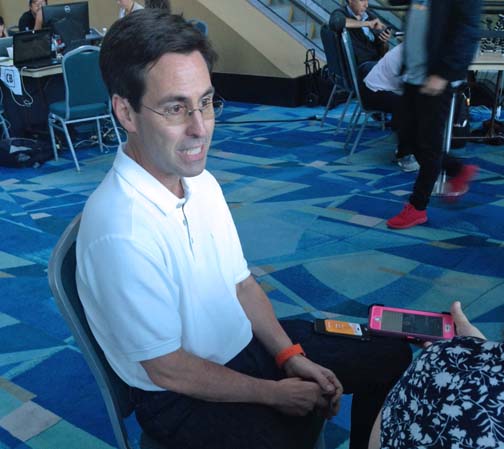

Puerto Rico is starting to see the “beginnings of an economic rebound,” as the effects of the influx of federal economic aid and the possibility of the return of pharmaceutical companies are putting the island in a better position heading forward. That optimism is there for José Rafael Fernández, CEO of OFG Bancorp, the financial […]

OFG Bancorp reported net income of $23.1 million, or $0.45 per fully diluted share, compared to $19.6 million during the third quarter of 2018, or $0.42 per share and the same year-ago quarter, when it made $13.6 million or $0.30 per share. For the year ended Dec. 31, 2018, the financial institution reported net income […]

The talks were geared toward strengthening Puerto Rico’s strategy in the global marketplace.

Oriental announced an alliance with renewable energy company, WindMar Home, to offer —the first time in Puerto Rico — financing for solar energy products.

Members of Puerto Rico’s banking sector testified at a House hearing to analyze the new Tax Reform under review, saying its principles are “step in the right direction.”

First BanCorp., the bank holding company for FirstBank Puerto Rico, reported net income of $33.1 million for the first quarter of 2018.

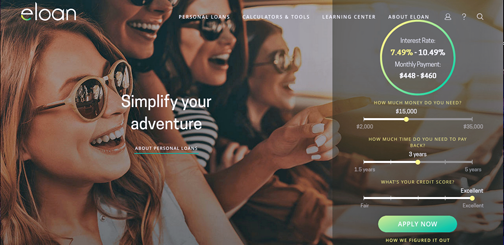

Two decades after pioneering in the digital banking solutions arena, online financial services platform Eloan is being relaunched to provide a “simpler and smarter” personal loans product at competitive rates, company officials said.

Five weeks after Hurricane María pummeled Puerto Rico, about 72.6 percent of local bank branches, or 228, have resumed operations, according to data from the Office of the Financial Institutions Commissioner.

Hurricane María’s devastating impact on Puerto Rico could eventually ring positive for the island’s economy, which has been crippled by a 12-year recession and the recent catastrophic storm.

Puerto Rico has been living through a storm for the past 12 years, and as with every storm, it has experienced different levels of intensity. But the current circumstances have to be handled quickly to be able to build the Puerto Rico that is needed, said José Rafael Fernández, CEO of Oriental Financial Group.

NIMB ON SOCIAL MEDIA