The Puerto Rico office of the U.S. Small Business Administration and the Puerto Rico Professional College of Engineers and Land Surveyors will cosponsor on May 8, the Annual Business Matchmaking Event both organizations have conducted jointly for the past eight years.

In line with its renewed service platform launched earlier this month to meet the needs of small and medium businesses, FirstBank and the Small Business Administration announced Monday the first closing under the agency’s pilot 504 loan refinancing program to Coamo Golf Bakery for $173,098.

The U.S. Small Business Administration approved 264 loans in Puerto Rico and the U.S. Virgin Islands during the first six months of fiscal year 2012, a 13 percent increase over loans approved during the same period the previous year, the agency said Thursday.

Women-owned businesses are one of the fastest growing sectors of our economy and are growing at twice the rate than any other group in the nation.

The Small Business Administration offers Puerto Rico small businesses tips on how to succesfully bid for federal government contracts.

If the results of the first quarter of the federal fiscal year are any indication, 2012 should be good for small and mid-sized business lending activity in Puerto Rico and the U.S. Virgin Islands, which is already picking up significantly in contrast to last year’s results.

José Sifontes, who held the post of U.S. Small Business Administration District Director for Puerto Rico and the U.S. Virgin Islands, José Sifontes, passed away Dec. 28, the agency announced Monday.

Advertising is a basic and valuable marketing tool for any small business. But developing and placing an ad does not mean it will immediately generate more sales.

Today is Veterans Day. And, in honor of the 23 million U.S. veterans that have watched over our safety and fought for our freedom, President Obama has declared the dates of Nov. 11-17 as National Veterans Awareness Week.

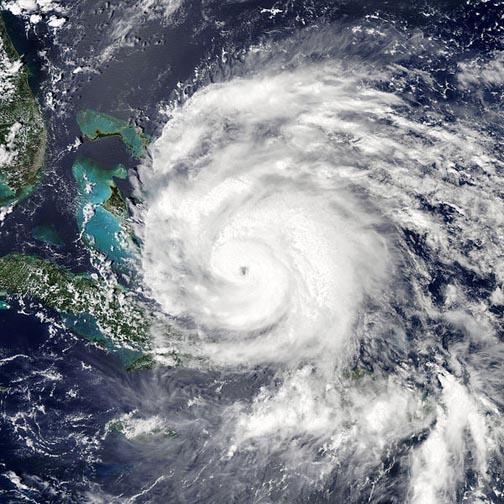

The U.S. Small Business Administration said Monday it has extended the deadline for homeowners, renters, businesses and nonprofit organizations in Puerto Rico to return applications for physical damage caused by Hurricane Irene. Since launching the assistance program in August, the agency has approved more than $3 million in loans.

The most effective form of marketing is word-of-mouth. But people can’t spread the word about you and your small business if they don’t know you.

The U.S. Small Business Administration guaranteed 656 loans in Puerto Rico and the U.S. Virgin Islands during fiscal year 2011, a 57 percent increase over loans approved during the previous year. The results obtained are due in part to incentives implemented under the Small Business Jobs Act of 2010 and to a renewed commitment from SBA lenders.

With just a week to go before the Oct. 26 deadline to submit disaster loan applications, the U.S. Small Business Administration announced Wednesday that so far it has approved $2 million in assistance for damages sustained by local businesses and residents in the wake of Hurricane Irene earlier this year.

The U.S. Small Business Administration this week reminded eligible private nonprofit organizations of the Oct. 26 deadline to submit disaster loan applications for damages caused by Hurricane Irene on Aug. 21-24, 2011. The agency also added Loíza, Peñuelas and San Juan to the eligibility list.

Right now, many communities are still feeling the aftermath of Hurricane Irene, including major floods in Puerto Rico. I can’t emphasize enough the importance of staying safe and listening to public officials. Flooding is still widespread and dangerous power lines are still down, so be sure to steer clear.

NIMB ON SOCIAL MEDIA