Amid news of credit degradation, income tax increases, rumors of raises in the sales and use tax, and possible changes to the federal minimum wage, you can almost hear the groans of small and medium business owners throughout Puerto Rico.

Puerto Rico Treasury Secretary Melba Acosta-Febo said Tuesday that preliminary General Fund net revenues for February totaled $670 million, exceeding estimated collections by $57 million.

The Puerto Rico Tourism Co. is kicking off an orientation campaign aimed toward short-term rental property owners who may not be complying with Law 272, which requires collecting a room tax from guests for each night they stay.

The Puerto Rico Treasury Department will start mailing out today more than 990,000 single, unified tax form that will standardize the reporting process corresponding to the 2013 taxable year.

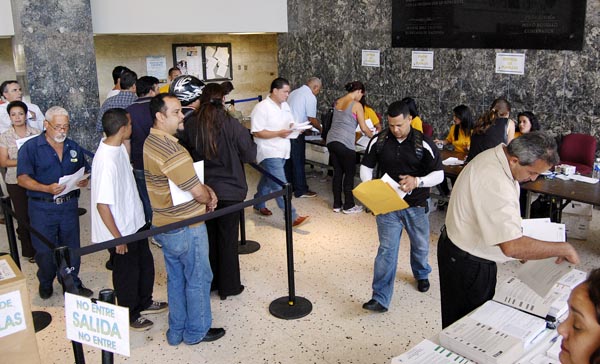

The Municipal Revenue Collections Center, known as CRIM by its initials in Spanish, announced Tuesday the start of a 100-day amnesty relieving taxpayers who are in arrears with the agency from paying interest, surcharges and penalties on their debt.

Puerto Rico corporations that close their books based on the calendar year, have until Friday (Oct. 25) to pay their estimated taxes, as per the recently enacted amendments to Law 117, Treasury Secretary Melba Acosta said Monday.

Thousands of jobs, businesses and consumer pockets are being threatened by a new national tax included in the Tax Burden Redistribution and Adjustment Law, which the Marketing, Industry and Food Distribution Chamber warned Monday could have “devastating effects.”

The Puerto Rico Restaurants Association, known as ASORE, sponsored a seminar Tuesday on the recently approved Law 40, which has brought on a new set of taxes, and its impact on the industry.

Preliminary analysis conducted by economic analysis firm Heidie Calero Consulting Group suggests the impact of new taxes implemented in Puerto Rico this month could lead to a reduction of 3.3 percent real growth during the next two fiscal years with a loss of up to 30,000 jobs.

The Made in Puerto Rico Educational Institute of the Puerto Rico Products Association will offer a seminar titled “Impact of the changes to Puerto Rico’s tax system on your business,” which aims to provide guidance on the recently enacted changes to the island’s tax code and their impact on local companies.

Puerto Rico Treasury Secretary Melba Acosta urged taxpayers and businesses to catch up on their tax debts during the amnesty period ending June 30, while announcing that starting July 1, the agency, in tandem with the Justice Department will be “much more active” in submitting tax evasion cases in court, especially those related to withheld taxes, either from employees or citizens who paid the sales and use tax.

The Puerto Rico Treasury Department reported Tuesday that net revenue General Fund collections for the month of May reached $612 million, exceeding by $15 million, or 2.6 percent, the collections on record for the same month in 2012.

Representatives from 26 professional organizations from a cross-section of Puerto Rico’s economy, as well as thousands of businesses and workers, on Monday asked Gov. Alejandro García-Padilla and his administration for “transparency” and inclusion in the decision-making process to find solutions to the island’s precarious fiscal situation.

Treasury Secretary Melba Acosta said Thursday that revenue collections so far this year — July 2012 through April 2013 — totaled $6.8 billion, or $321 million less than originally included in the general budget. The projection of a deficit through June 30, including certain transactions that will close before then, is $295 million, or 69 percent less than the original $965 million projected deficit, one of the components of the $2.2 billion structural deficit.

The head of the Puerto Rico Society of CPAs expressed concern Wednesday over the changes the current administration is proposing to the sales and use tax structure, specifically, the elimination of the business-to-business exemption.

NIMB ON SOCIAL MEDIA