Doral Bank has reached a deal with the Treasury Department regarding $200 million in overpaid taxes that the bank will now write off in its books as a prepaid expense.

General Fund net revenue totaled $674 million in February, an increase of $97 million or 16.8 percent, when compared with February 2011.

A deduction on the tax return is allowed for an unforeseen loss of the principal residence of a taxpayer incurred during the taxable year.

The Treasury Department is keeping up the pace in processing this year’s tax returns, reimbursing more than $28.7 million to 31,494 taxpayers who have filed their planillas well ahead of this year’s April 17th deadline, agency Secretary Jesús Méndez said.

The Treasury Department pumped $731 million into the government’s General Fund last month, or $216 million more than what it collected during January 2011. The 42 percent hike was fueled by income and excise taxes, Treasury Secretary Jesús Méndez said Thursday.

About 25 percent more Puerto Rico taxpayers will be able to file the short form this year as the 2010 Tax Reform takes full effect, simplifying many reporting processes that previously required the more complicated long form, Treasury Deputy Secretary Blanca Álvarez-Ramírez told News is my Business.

Net General Fund revenue totaled $776 million in December, representing an increase of $210 million when compared to the same month in 2010. The hike was attributed to a surge in motor vehicle excise tax collections, which Treasury Secretary Jesús Méndez said reflected the highest year-over-year percentage growth.

Fueled by vehicle fleet sales, Puerto Rico’s auto industry reported a 1.5 percent growth in 2011 that is expected to continue this year, when growth projections are pegged at between 1 percent and 3 percent, the United Automobile Importers Group said Thursday.

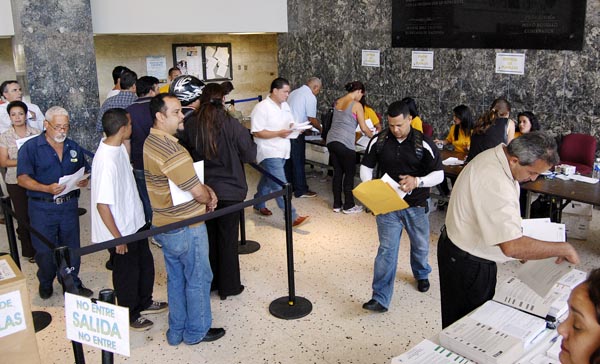

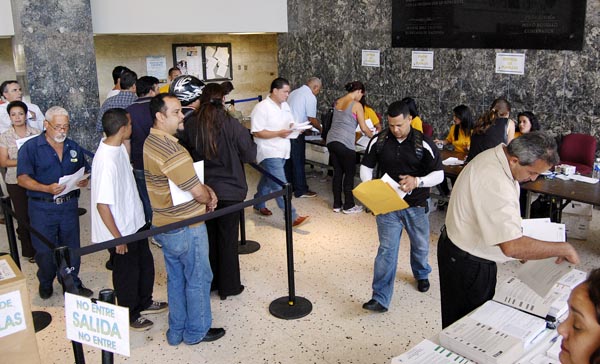

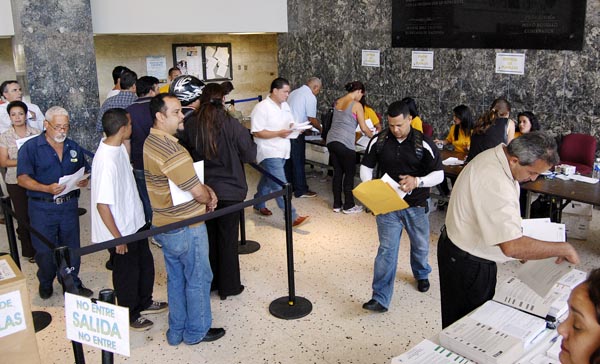

In preparation for this year’s tax season, the Treasury Department announced Tuesday it has already opened six centers throughout the island to orient taxpayers on the terms of the Law to Strengthen Public Health and Safety and the recently granted tax credit for citizens who are 65 or older.

A proposal in President Barack Obama’s deficit reduction plan unveiled Monday could put a wrench in the joint aspirations of the local government and the private sector to get improved tax conditions for controlled foreign corporations doing business on the island.

Software giant Microsoft has reportedly been using three jurisdictions where it operates outside the United States — Puerto Rico, Ireland and Singapore — as tax shelters to reduce its federal tax bill, the Financial Times reported.

Sales and use tax collections remain steady during the first 10 months of the current fiscal year, a pattern Treasury Department Secretary Jesús Méndez said is the result of several measures the administration has implemented to shore up much-needed cash for the government.

Puerto Rico residential property owners who have yet to register their units with the Municipal Revenues Collection Center, or CRIM, have until mid-June to do so to avoid being the target of potentially significant fines, government officials said Monday.

NIMB ON SOCIAL MEDIA