Puerto Rico Treasury Department officials confirmed Wednesday that the agency is still reviewing 7 percent of all tax returns claiming a refund.

The Puerto Rico Treasury Department announced Thursday it has issued a circular letter to guide retailers and service providers on changes in the Sales and Use Tax (IVU, by its initials in Spanish) exemption between business services, or "B2B", which took effect July 1.

Puerto Rico Treasury Secretary Melba Acosta said Monday the tax amnesty that concluded June 30 shored up $255 million for the government, beating expectations by 27 percent. The agency initially projected it would collect $200 million through the campaign.

Puerto Rico Treasury Secretary Melba Acosta urged taxpayers and businesses to catch up on their tax debts during the amnesty period ending June 30, while announcing that starting July 1, the agency, in tandem with the Justice Department will be “much more active” in submitting tax evasion cases in court, especially those related to withheld taxes, either from employees or citizens who paid the sales and use tax.

The Puerto Rico Treasury Department reported Tuesday that net revenue General Fund collections for the month of May reached $612 million, exceeding by $15 million, or 2.6 percent, the collections on record for the same month in 2012.

Treasury Secretary Melba Acosta said Thursday that revenue collections so far this year — July 2012 through April 2013 — totaled $6.8 billion, or $321 million less than originally included in the general budget. The projection of a deficit through June 30, including certain transactions that will close before then, is $295 million, or 69 percent less than the original $965 million projected deficit, one of the components of the $2.2 billion structural deficit.

The Puerto Rico Treasury Department is currently working on a number of enforcement and automation initiatives to increase the island’s sales and use tax uptake from the current 68 percent while attacking the government’s fiscal shortfall, agency Secretary Melba Acosta told participants of the Puerto Rico Credit Conference Friday.

Puerto Rico individual and corporate taxpayers who have a sales and use tax (known as IVU for its initials in Spanish) debt with the Treasury Department will be able to pay without penalty through a tax amnesty good through June 30. The agency expects to collect $8 million through the initiative, Treasury officials said Monday.

Puerto Rico Treasury Department officials told lawmakers Friday that collections stemming from the proposed increase in the excise tax on cigarettes and tobacco should go in their entirety to the General Fund and not distributed for other purposes, as proposed by the three measures under consideration by the Legislature.

Government Development Bank President Javier Ferrer and Puerto Rico Treasury Secretary Melba Acosta- took off to New York Wednesday to meet with credit ratings agencies S&P, Fitch and Moody’s to continue informing on the administration’s efforts to stabilize the government's finances.

The head of the Puerto Rico Society of CPAs expressed concern Wednesday over the changes the current administration is proposing to the sales and use tax structure, specifically, the elimination of the business-to-business exemption.

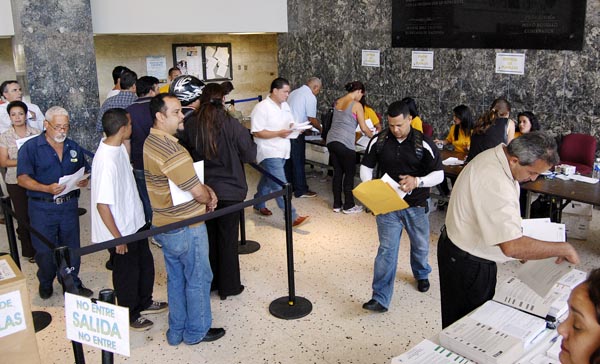

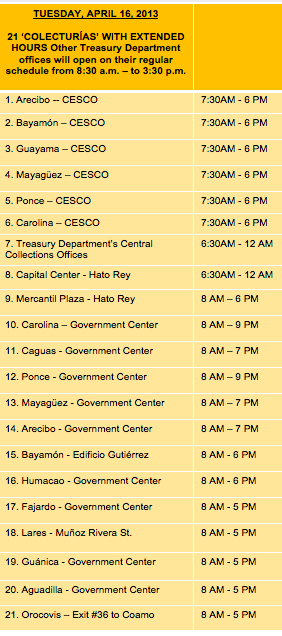

Thousands of last-minute taxpayers are expected to file their returns in Puerto Rico today, and the Treasury Department is responding by offering extended hours at 21 collections centers, and its headquarters in Puerta de Tierra, agency Secretary Melba Acosta said Monday.

Amid outcry from many public workers who will see their pension benefits dwindle once they retire from their government jobs, Puerto Rican lawmakers approved and Gov. Alejandro García-Padilla signed a sweeping reform aimed at “rescuing” Commonwealth’s Employees Retirement System.

The Puerto Rican government’s economic team is in Washington D.C. this week to “disclose and advance plans to stabilize the government's finances and revive the island’s economy,” the Treasury Department said Monday.

The Puerto Rico Treasury Department is embarking on a pursuit of taxpayers who defrauded the government’s coffers either by under-reporting on their income taxes or failing to file altogether, agency Secretary Melba Acosta said Thursday.

NIMB ON SOCIAL MEDIA