Bankers Assoc. educates about financial exploitation

The Puerto Rico Bankers Association is urging local citizens to help prevent fraud and financial exploitation in people who may be vulnerable, including the handicapped and the elderly.

Financial exploitation is defined as the use of funds, property or resources of an elderly person by another individual for personal gain. This can be accomplished through fraud, embezzlement, forgery of documents and records, coercion, transfer of ownership or denying access to their property.

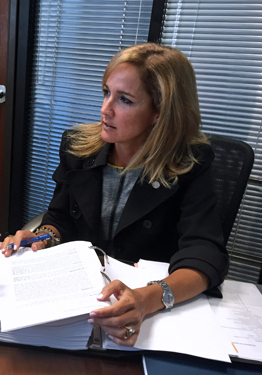

Many elderly victims of financial exploitation face problems when meeting their payments, and in some cases even lose their home for trusting unscrupulous people, Bankers Association Executive Vice President Zoimé Álvarez-Rubio said.

“For the banking sector, it remains of great interest and importance to continue guiding the public about this form of financial exploitation to prevent and avoid future cases like these from emergin,” she said.

“It is important to guide our elderly or disabled parents and relatives on some of the warning signs and stay in constant communication with them to help care for their financial, physical and emotional well-being,” Álvarez-Rubio said.

The said, generally speaking, people whom fall victim of financial exploitation do so at the hands of close ones or family members who abuse their trust. Among the warning signs of financial exploitation, she mentioned the following: late payments or unpaid new accounts; sudden lack of funds in their bank accounts; suspicious signatures on checks and account statements; statements are sent to another address; sudden and unjustified changes in important documents such as, for example, a will or power of attorney; the victim has new “close ones” or “trusted people” who want to go with them when going to the bank.

To prevent someone from falling victim of financial exploitation the Bankers Association offered the following recommendations:

- If you notice any of the warning signs, try to identify the person who may be financially exploiting the family member or acquaintance. Then report the situation or suspect to the authorities. Similarly, you can communicate confidentially with the manager of the bank branch in which the affected person keeps their accounts, to inform them about the situation.

- If for some reason it is necessary to appoint a representative to conduct personal and/or financial business on behalf of an elderly relative, choose wisely. Remember that it never hurts to double-check references.

- Also, keep abreast of the efforts that this representative is doing on behalf of the family member and regularly monitor their account activities. In addition, regularly contact the family member, as well as the representative to make sure everything is in order.

Puerto Rico’s banking institutions have financial exploitation prevention and detection protocols in place to protect elderly or handicapped people.