Evertec and ATH announced that their ATH Móvil service has reached one million users since its inception four years ago.

The Federal Housing Administration (FHA) announced expanded mortgage relief to FHA-insured homeowners who live or work in areas impacted by Hurricanes Harvey, Irma and María as well as California wildfires and subsequent flooding and mudslides.

EVERTEC Inc. announced results for the fourth quarter and full year ended Dec. 31, 2017, reflecting a 2 percent revenue drop, to $99.6 million, during the three-month period, but a 5 percent increase to $407.1 million for the 12-month period.

Sun West Mortgage announced the opening of third branch in Puerto Rico, which called for an investment of some $200,000, located at the Ciudadela complex in Santurce.

Banco Popular de Puerto Rico has agreed to acquire Wells Fargo & Company’s auto finance business in Puerto Rico, which operates as Reliable Financial Services Inc. and Reliable Finance Holding Company, for $1.7 billion, the financial institution announced.

Draco-Risk has set up shop in Puerto Rico and the U.S. Virgin Islands to assist customers in the process of receiving just and correct payments from the insurance companies in their claims, after hurricanes Irma and María.

An estimated 300,000 Banco Popular customers participated in Banco Popular de Puerto Rico’s loan moratorium program, which included personal, auto, leasing, and mortgage loans, as well as credit cards, bank officials said Thursday.

OFG Bancorp reported results for the fourth quarter and year ended Dec. 31, 2017, which reflected net income available to shareholders increased to $13.6 million, or $0.30 per share fully diluted, from a net loss of $146,000, or $0.00 per share, in 3Q17. OFG reported net income of $12.1 million, or $0.27 per share fully diluted, in 4Q16.

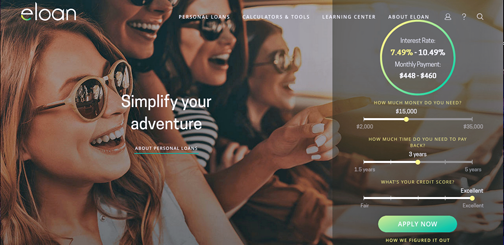

Two decades after pioneering in the digital banking solutions arena, online financial services platform Eloan is being relaunched to provide a “simpler and smarter” personal loans product at competitive rates, company officials said.

First BanCorp. reported net income of $24.2 million for the fourth quarter of 2017, or $0.11 per diluted share, compared to a net loss of $10.8 million, or $0.05 per diluted share, for the third quarter of 2017 and net income of $23.9 million, or $0.11 per diluted share, for the fourth quarter of 2016.

Popular Inc. reported a net loss of $102.2 million for the quarter ended Dec. 31, 2017, compared to a net income of $20.7 million for the prior reflecting a non-cash income tax expense of $168.4 million due to the impact of the Federal Tax Cut and Jobs Act in the corporation’s U.S. deferred tax asset.

Triple-S went public on the New York Stock Exchange 10 years ago, and since then, its assets have grown $1.7 billion in December of 2017 to $3.1 billion in September of 2017, for an increase of 82 percent, two of its high-ranking executives confirmed.

Triple-S Salud is betting on the growth of entrepreneurship in Puerto Rico and has developed a strategy to serve the health needs of this group that includes digital tools to buy an individual plan online, as well as new benefits that sets them apart from the competition, the company announced.

The HIMA-San Pablo hospital system has re-entered the MMM Healthcare provider network, to offer healthcare services at its facilities in Caguas, Humacao, Fajardo and Cupey, executives representing both companies announced.

NIMB ON SOCIAL MEDIA