Doral Bank is looking to reduce its energy footprint and contribute to better local environmental conditions with a $1 million overhaul of its Roosevelt Ave. headquarters lighting systems.

BBVA Puerto Rico, one of the few banks that has successfully weathered the island's protracted financial meltdown, is looking to increase its local market share to 10 percent over the next five years, a high-ranking official said Wednesday.

First BanCorp on Friday informed the Securities and Exchange Commission that it will not be able to file its annual report for the year ended Dec. 31, 2010 on time, “without unreasonable effort and expense,” as it has not finished preparing the documents for that filing period.

New York-based real estate auctioneer Sheldon Good & Co. and Banco Popular de Puerto Rico announced Wednesday an upcoming joint auction of 101 luxury residences and villas located in five developments throughout the island.

For the fourth time in the past five years, Banco Santander Puerto Rico has landed a spot on the list of “Best Emerging Market Banks in Latin America,” a ranking published by the editors of Global Finance magazine that includes 23 countries in Central and South America and the Caribbean.

FirstBank Puerto Rico recently won a foreclosure case worth $83.1 million related to an upscale residential development project located at the heart of Coral Gables, the South Florida Business Journal reported.

OCIF Chief Alfredo Padilla offers details on new Institute, as education division director Velia Cardona looks on. Financial Institutions Commissioner Alfredo Padilla announced Monday the creation of the Financial Education Institute, whose main goal is to offer financial education to island residents. The Institute will operate two areas: a Research and Analysis Center, equipped with […]

Nearly a year after Puerto Rico’s banking sector experienced a meltdown of historic proportions with the closing of three financial institutions, Financial Institutions Commissioner Alfredo Padilla said Friday that 2011 should be a “turnaround year” for the industry.

Puerto Rico’s main banks had more than $75.6 billion in combined assets at the end of 2010, reflecting a year-over-year drop of 15.6 percent, according to a report released by the Office of the Commissioner of Financial Institutions.

Just two months after announcing its intent, First BanCorp on Wednesday confirmed it has entered into a definitive agreement to sell a loan portfolio with an unpaid principal balance of $516.7 million to a newly created joint venture between Goldman, Sachs & Co. and Caribbean Property Group.

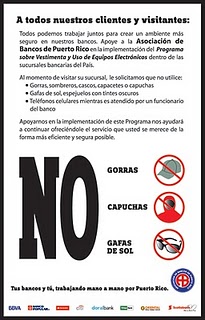

Attention Puerto Rico bank customers: Starting Feb. 14 individuals will not be allowed to wear sunglasses or hats while conducting a transaction at a local bank branch. Mobile telephone use will also be limited.

UBS Financial Services Inc. of Puerto Rico is facing a possible lawsuit by the U.S. Securities and Exchange Commission, which recently issued a Wells notice regarding the sale of mutual funds that bought $1.5 billion in bonds that the Swiss-based bank had underwritten on the island, Bloomberg reported Friday.

Oriental Financial Group on Thursday released its fourth quarter report, showing strong performance in core banking operations, just several months after settling into its expanded footprint resulting from its acquisition of the former EuroBank.

Popular Inc. continues taking steps toward improving its balance sheet with an announcement Monday that it has signed a non-binding letter of intent to sell approximately $500 million of construction and commercial real estate loans. Some 75 percent of the loans, which will be sold at book value, are non-performing.

Putting an end to what seemed to be a pretty open secret, Triple-S Management Corp. on Tuesday announced that its subsidiary Triple-S Salud Inc. will purchase American Health Inc.’s parent company, for some $82 million in cash.

NIMB ON SOCIAL MEDIA