FirstBank extends Beyond Mobile service to Beyond credit card customers

FirstBank announced it has extended its Beyond Mobile service to its Beyond credit card customers, to offer greater convenience and security in their banking transactions.

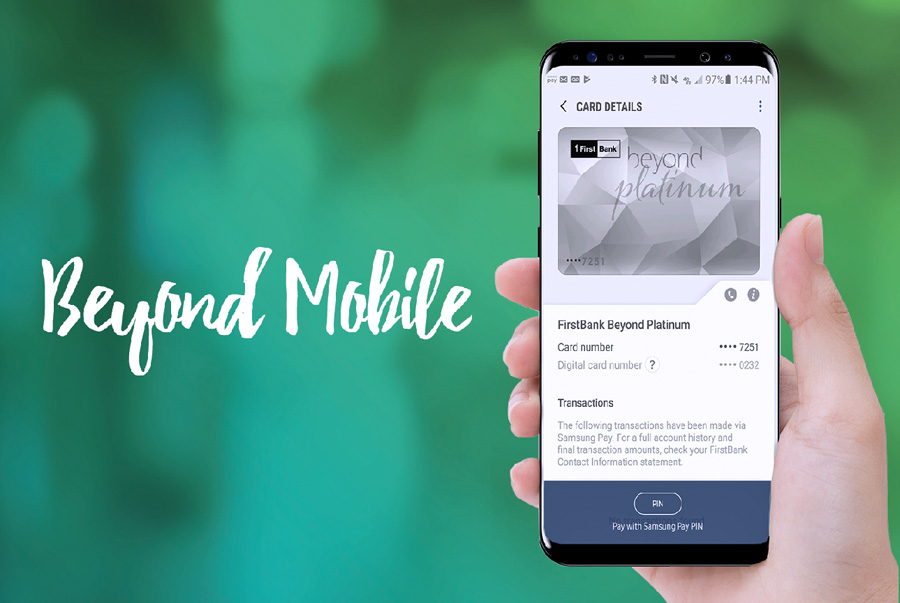

The new service, known in the market as “digital wallet,” allows customers to make payments at business establishments without having to physically show their card.

To start getting the benefits and security of the Beyond Mobile digital wallet service, customers must have a mobile phone, download the Samsung Pay or Google Pay app, and fill out their credit card information.

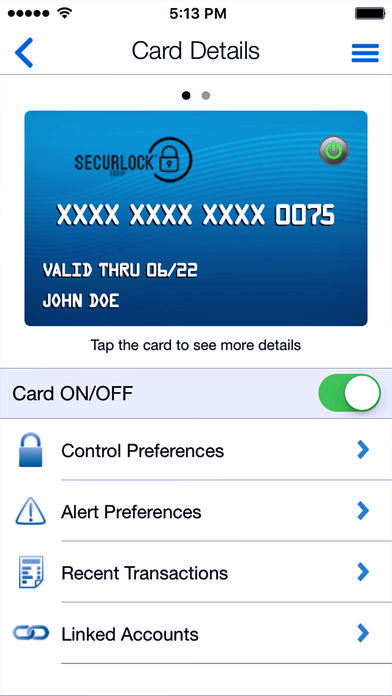

When they subscribe to Beyond Mobile, a virtual credit card number or token will replace the actual number on the credit card. This unique number will be exclusively linked to that mobile phone, thus providing the customer with greater security when they make purchases at businesses with terminals that are enabled for this type of transaction.

At the same time, FirstBank is launching its Fraud Alert Service through email and/or text messages for customers with Beyond, Visa Debit, or Visa Business cards. All customers with a mobile phone and/or email address registered in the system will begin to receive fraud alerts whenever any suspicious or fraudulent activity is detected.

“At FirstBank we have been working on the innovation and optimization of our products and services. Our customers with FirstBank Beyond Visa or MasterCard credit cards issued in Puerto Rico and Florida can begin to enable the Beyond Mobile service for transactions made in all establishments in Puerto Rico and abroad with compatible technology,” said Juan Carlos Vázquez, senior vice-president of consumer banking at FirstBank.

The banking institution offered tips for protecting transactions, including: (1) review account statements frequently to identify any fraudulent transactions; (2) do not lend a credit or debit card to anyone; (3) verify that the websites where the customer makes internet purchases have a security certificate; (4) sign the card on the back so that businesses can have another way of identifying the user; (5) if a customer detects unauthorized or unrecognized charges, they should call 1-877-598-4584 for credit cards and 1-866-725-2511 for Visa Debit o Business debit cards, or send a letter by regular mail to the address shown on your account statement within the period established for submitting claims.