Banco Popular added 40,000 new clients, as other financial institutions opted to close branches after Hurricane María tore through the island last year.

Nearly five months after announcing its intention to buy Wells Fargo’s auto lending business in Puerto Rico — which does business as Reliable Auto — Popular Inc. confirmed it has completed the regulatory clearance process needed to close the deal.

Four months after announcing it had agreed to acquire Wells Fargo’s auto finance business in Puerto Rico, which operates as Reliable Financial Services Inc., Banco Popular de Puerto Rico confirmed it has filed a notice with the Federal Reserve System to close the deal.

Popular Inc. announced that, on May 22, its subsidiary Banco Popular entered into a Termination Agreement with the Federal Deposit Insurance Corp.

They say that times of crisis ignite the spark of creativity and elicit the best ideas. With this in mind, the Banco Popular Foundation and the Hispanic Federation announced the launch of the “Puerto Rico Big Ideas Challenge,” a contest of innovative ideas with a social impact with awards of up to $1.5 million.

Since 2016, StartUp Popular has been supporting business owners in Puerto Rico through financing, business coaching and networking events.

Banco Popular de Puerto Rico has agreed to acquire Wells Fargo & Company’s auto finance business in Puerto Rico, which operates as Reliable Financial Services Inc. and Reliable Finance Holding Company, for $1.7 billion, the financial institution announced.

Popular Business Solutions, a set of tools that make it easier for merchants to manage their businesses on a daily basis has been relaunched, bank officials announced.

An estimated 300,000 Banco Popular customers participated in Banco Popular de Puerto Rico’s loan moratorium program, which included personal, auto, leasing, and mortgage loans, as well as credit cards, bank officials said Thursday.

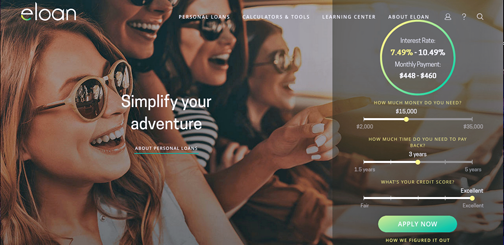

Two decades after pioneering in the digital banking solutions arena, online financial services platform Eloan is being relaunched to provide a “simpler and smarter” personal loans product at competitive rates, company officials said.

Popular Inc. reported a net loss of $102.2 million for the quarter ended Dec. 31, 2017, compared to a net income of $20.7 million for the prior reflecting a non-cash income tax expense of $168.4 million due to the impact of the Federal Tax Cut and Jobs Act in the corporation’s U.S. deferred tax asset.

Popular Inc. reported a net income of $20.7 million for the third quarter ended Sept 30, 2017, compared to a net income of $96.2 million for the quarter ended June 30, 2017.

Five weeks after Hurricane María pummeled Puerto Rico, about 72.6 percent of local bank branches, or 228, have resumed operations, according to data from the Office of the Financial Institutions Commissioner.

Two of the island’s major banks, Banco Popular and FirstBank, stepped up Tuesday to help consumers during the hurricane-invoked emergency, offering three-month moratoriums a number of payments, including on mortgages and credit cards.

Three of the island’s largest banks announced their operating schedules for Tuesday, when limited service will be offered throughout Puerto Rico.

NIMB ON SOCIAL MEDIA